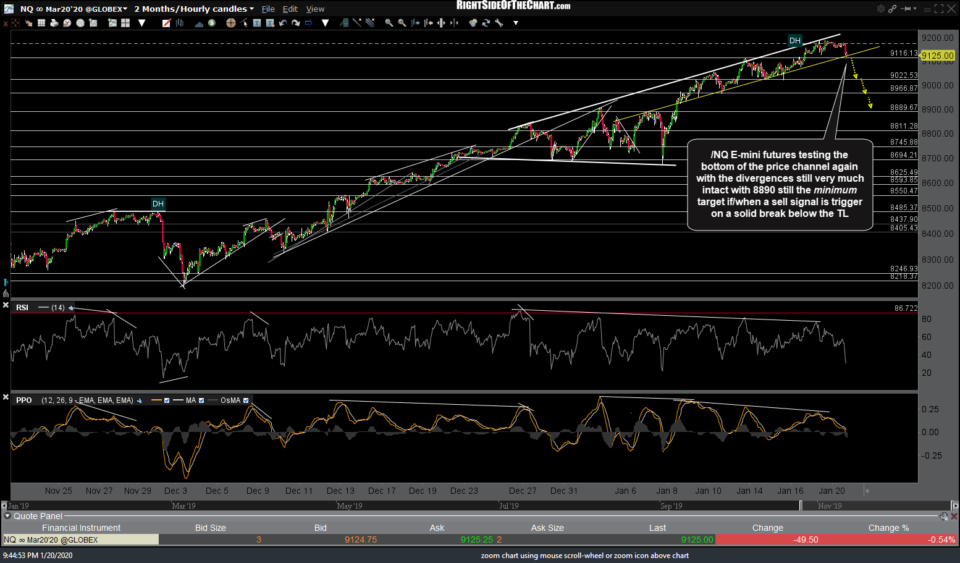

/NQ (Nasdaq 100) E-mini futures are once again testing the bottom of the price channel (key yellow uptrend line) once again with the divergences still very much intact. The 8890 support level, which is now about 2½% below current levels, is still the minimum target if/when a sell signal is triggered on a solid break & 60-minute candlestick close below the trendline. Previous (Jan 15th) & updated 60-minute charts below.

- NQ 60m Jan 15th

- NQ 60m Jan 20th

Please note that I will be away from my desk most of the day tomorrow (Tuesday) during & after market-hours. I will be at my desk until 9 am tomorrow so I’ll post a follow-up on the other stock indexes including the index-tracking ETFs, should /NQ go on to make a convincing break of this trendline in the overnight or early hours session. Barring any major developments in the markets or any of the recent trade ideas, market analysis & trade updates will resume as normal late Tuesday evening or Wednesday morning.