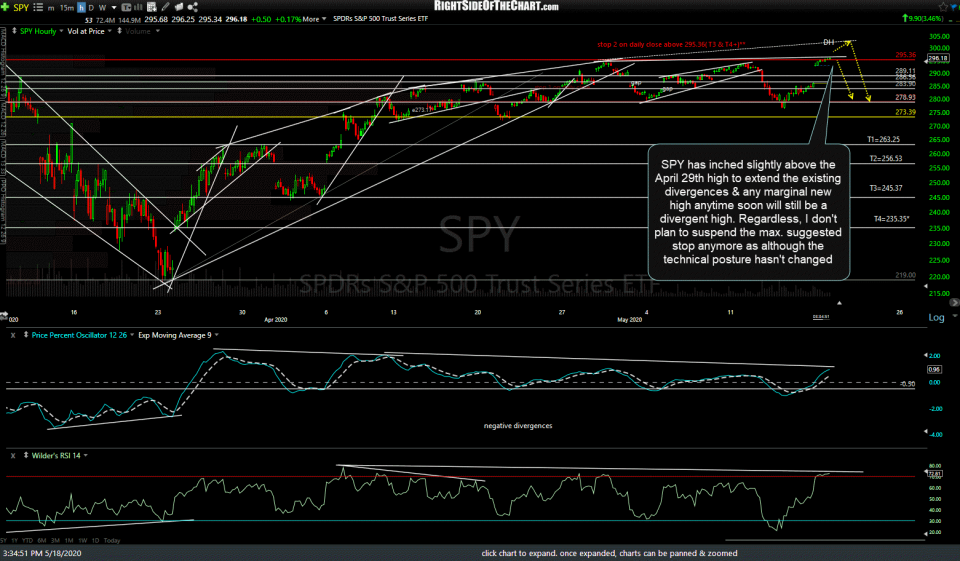

SPY has inched slightly above the April 29th high to extend the existing divergences & any marginal new high anytime soon will still be a divergent high. Regardless, I don’t plan to suspend the max. suggested stop going forward although the technical posture hasn’t changed. While I’m planning to sit tight on my index swing shorts personally for now, due to the multi-week sideways grind in the broad market with the suggested stop at the top of the range, this trade has become more of a time-consumer with multiple revisions to the stop each time SPY bumps up against the top of this range & as such, the official trade will be stopped out if SPY closes above 295.36 today or anytime going forward.

Zooming out to the bigger picture via the weekly chart below, SPY continues to try around the key 40-week EMA & 61.8% Fib since first testing those levels about a month ago, as well as within the large broadening wedge pattern. When analyzing the weekly charts, the most important thing is where the weekly candlesticks close the week (end of day Friday) vs. any intraday week moves as that helps to minimize whipsaw signals.