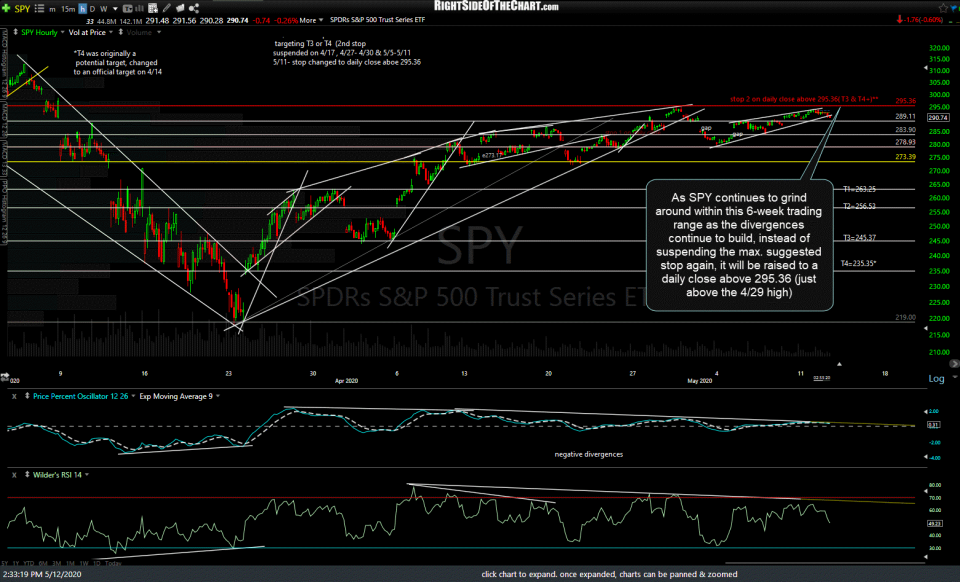

As SPY continues to grind around within this 6-week trading range as the divergences continue to build, instead of suspending the max. suggested stop again, it will be raised to a daily close above 295.36 (just above the 4/29 high). I also need to cut out early today & won’t be around for the final hour of trading today & as such, I won’t be able to assess the price action heading into the close today (another reason for modifying vs. suspending the stop). This modification to the maximum suggested stop will provide just under a 2:1 R/R to the current final target (T4) although there is still a good chance that additional targets will be added to this trade or the next SPY short trade, should the revised stop be taken out.

The bigger picture has the S&P 500 trading just below the key 200-day EMA as well price resistance & the 61.8% Fibonacci retracement level of the 36% drop off the Feb 19th high into the March 23rd low (i.e.- the broad market has retraced half of that drop) as covered in today’s earlier video.