I plan to spend some time cleaning up the Active Trade Ideas on the site, i.e- removing trades that have either hit their final price target or suggested stop to from the Active Trades categories (short or long) to the Completed Trades archives.

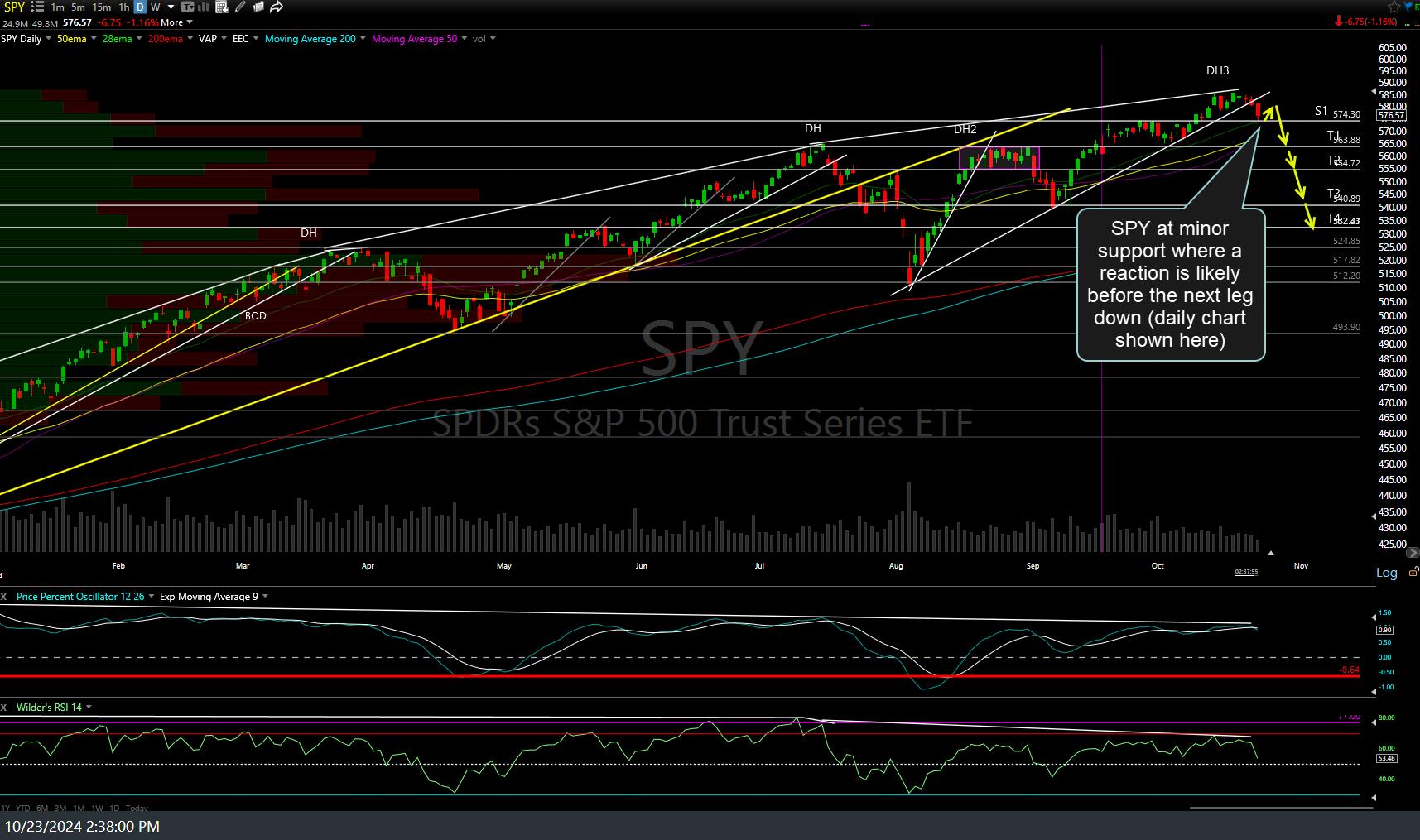

SPY barely clipped (within mere basis points) the suggested stop of 595.60 yesterday for~2% loss before closing below that level so I will be removing it from the Active Trades category although this is simply a backtest of the Aug 5th uptrend line with the divergences still very much intact (i.e.- no change in the technical posture or longer-term outlook at this time). Previous & updated daily charts below.

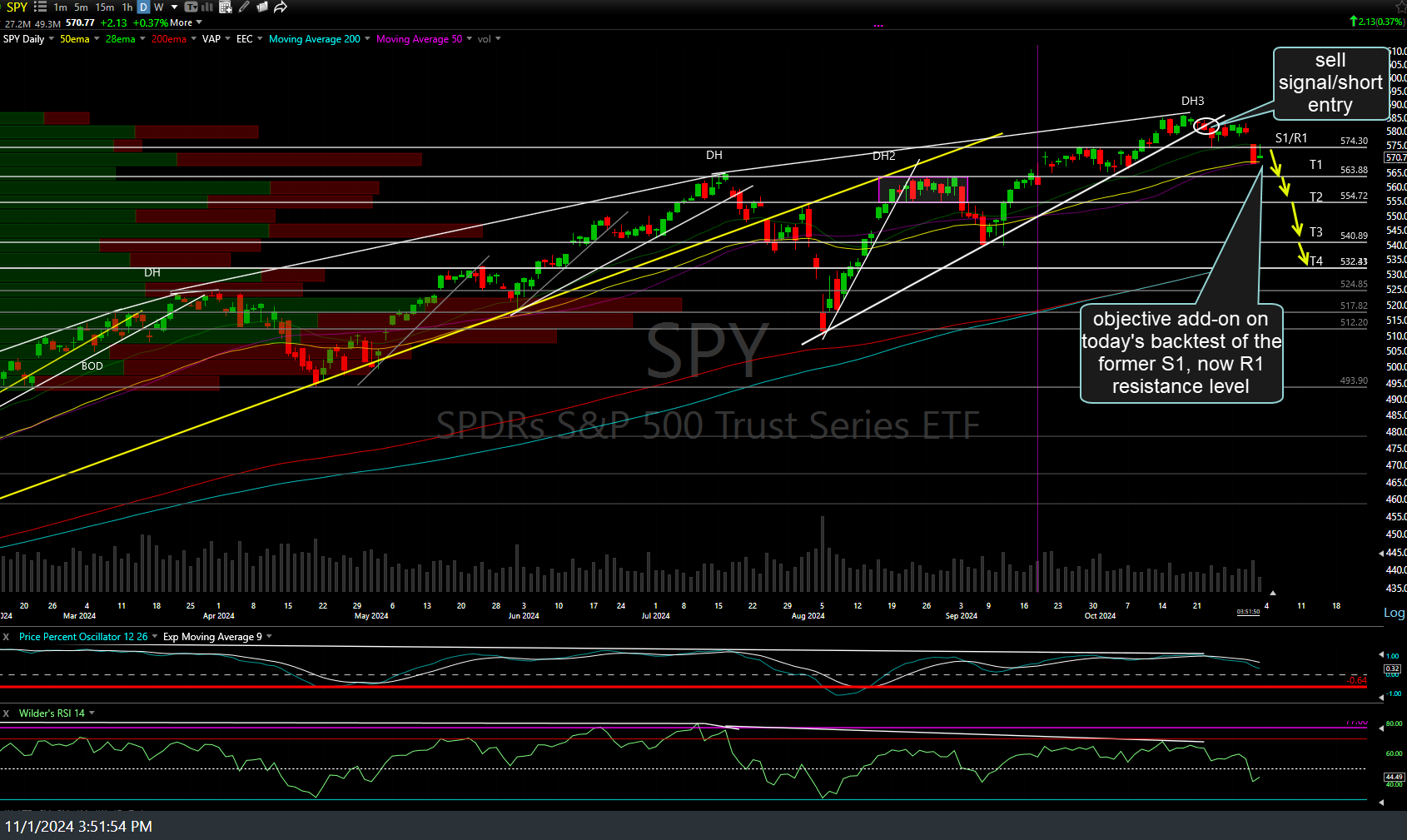

As per my recent comments, the technical posture of the major stock indices (SPY & QQQ) hasn’t changed this week (other than a marginal new & still divergent high in SPY) despite the post-election & FOMC rallies, although that could change as early as next week. My preference remains to keep things (equity trades that are correlated with the broad market) light overall for now while watching to see how the bond market handles the key resistance levels currently being tested on $TNX & $TYX (10 & 30-yr Treasury bond yields), among other things.

For those giving this trade a little more room (in addition to keeping position sizes small, I has also suggested widening stops for this volatile week), keep in mind that I opted for a unusually tight stop allowance (~2%) on this trade, with an very favorable R/R of 4:1 just to the final near-term swing target (T4), while still maintaining that *IF* SPY gets anywhere close to that 4th price target on the daily charts from this swing trade, the odds of my longer-term trend targets that were first laid out on June 26th on the weekly chart of SPY (which I still favor being hit over the next year or so) will have increase substantially. More updates on the broad market to follow later today.