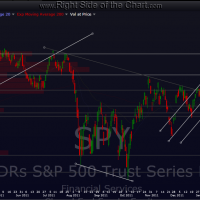

at this risk of getting ahead of myself, as technically, we are still in an uptrend that began over a month and a half ago, here is my primary scenario for the SPY. i’ve also included the previous daily charts which illustrate how we nailed the move down from the markets bull market highs in early april down to the exact bottom on june 4th (well, in full disclosure: although i posted the top of my target zone was hit on the 4th and started covering, i wasn’t able to get the post out officially declaring the switch from short to long bias until 12:17am on the 5th, 17 minutes after the official bottom on the east coast but still on the june 4th official bottom for the remaining time zones).

i haven’t yet decided what would nullify this primary scenario, which technically becomes effective once/if we break the 7/12 lows and will most likely happen this week. as market conditions & the charts can & will change, i will update or modify this scenario as needed. when trading, it can become easy to get lost in the intraday charts, especially following a period of choppy price action and going to a more active hit-n-run trading style. as mentioned last week, i started gradually moving away from that active trading style back towards my usual swing-trading style by widening my stops and expanding the targets on my short trades. it is the daily and weekly charts that help me decide whether to employ an overall long or short bias as well as whether to use an active or more passive (swing) trading style and the intraday charts that help hone the entry & exits on my trades.

although we still have quite a bit of work to do from a technical perspective in order to state with a high degree of confidence that this market is going to fall to that new initial target (as in first target, with possibly more to come), if my read on the market is correct, that confirmation could come much faster than most expect. confirmation would, among other things, mean a break below the support shown at 129.70 & 127.14 as well as confirmation of some additional long-term sell signals on the weekly and monthly charts. SPY daily charts starting with the april 3rd chart ending with today’s updated chart: