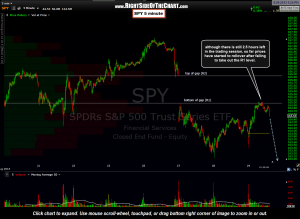

With another 2 1/2 hours left in the trading session, it’s too early to declare victory yet but it is worth pointing out that the SPY is starting to rollover after failing to surmount the R1 resistance level. If prices do continue to move lower into the close today (my preferred scenario), I would view that as a very bearish technical event.

With another 2 1/2 hours left in the trading session, it’s too early to declare victory yet but it is worth pointing out that the SPY is starting to rollover after failing to surmount the R1 resistance level. If prices do continue to move lower into the close today (my preferred scenario), I would view that as a very bearish technical event.

Yesterday afternoon, as the SPY was approaching the highlighted support level on my 60 minute chart where I expected a reaction, I mentioned how both the MACD & RSI were forming higher lows, i.e.- positive divergence. In long or intermediate-term uptrend, rarely will you see an index fall to a key support level with positive divergences in place that is not followed by a meaningful and sustained rally. The SPY very well may just be taking a breather here before powering up through R1 and going on to backfill the gap but so far, volumes on this bounce are low and another potential red flag to this rally (for lack of a better word as the SPY is on up 1/3rd of 1%) would be the fact that treasury bonds are catching a nice bid today, indicating a possible flight to safety by the smart money (something factored into my reasoning for turning bullish on bonds recently).

One day does not make a trend nor does the price action of the last few hours so I’ll be watching to see how equities and bonds trade throughout the day and over the next few trading sessions. It is also worth mentioning that any significant downside or even sideways price action over the next few trading sessions will trigger a death cross on the 20/50 daily ema pair, a signal that has only happened three times in the last couple of years, each confirming an intermediate-term downtrend was in place.

One day does not make a trend nor does the price action of the last few hours so I’ll be watching to see how equities and bonds trade throughout the day and over the next few trading sessions. It is also worth mentioning that any significant downside or even sideways price action over the next few trading sessions will trigger a death cross on the 20/50 daily ema pair, a signal that has only happened three times in the last couple of years, each confirming an intermediate-term downtrend was in place.