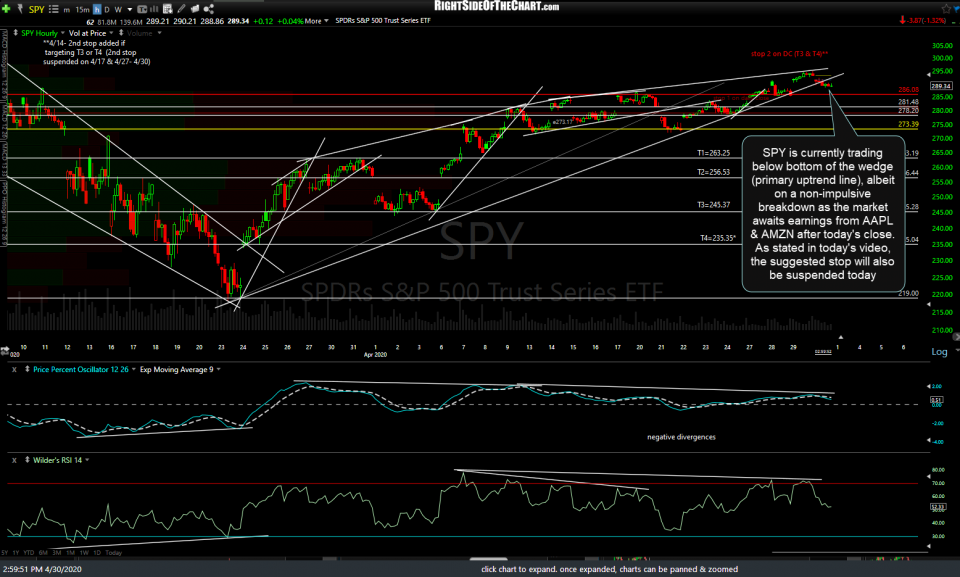

SPY is currently trading below the bottom of the wedge (primary uptrend line), albeit on a non-impulsive breakdown as the market awaits earnings from AAPL & AMZN after today’s close. As stated in today’s video, the suggested stop will also be suspended today.

QQQ is also cracking below the primary uptrend line/rising wedge pattern non-impulsively, just as with Tuesday’s whipsaw breakdown, as the market awaits earnings from AAPL & AMZN after today’s close.

Any marginal new high in AMZN will be a divergent high while new high or not, a solid break below this primary uptrend line off the March lows will trigger a sell signal on the stock.

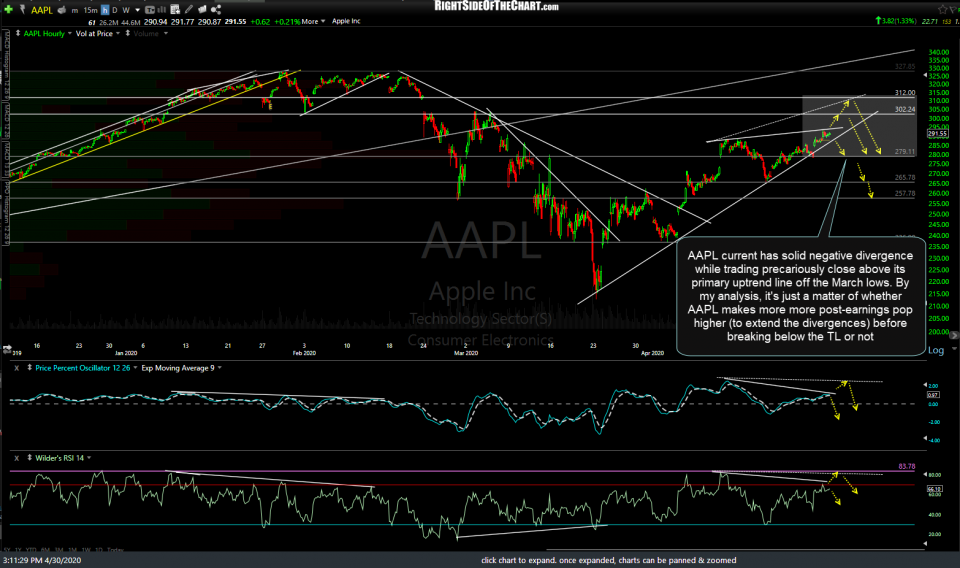

AAPL current has solid negative divergence while trading precariously close above its primary uptrend line off the March lows. By my analysis, it’s just a matter of whether Apple makes one more post-earnings pop higher (to extend the divergences) before breaking below the trendline or not. Either way, we should have a good idea by the market close tomorrow or early next week at the latest. Should AAPL power through the bearish divergences and the first two resistance levels above (302.24 & 312), the 327.85 is the next significant resistance level as that is where the stock stalled out for 3-weeks following its previous quarterly earnings report.