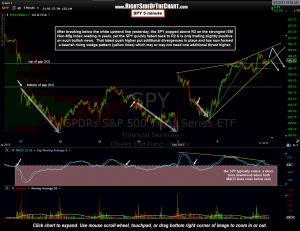

Nothing new to report on the longer-term charts (daily & weekly) other than the fact that the $SPX death cross remains in place despite another up day in the index so here’s a quick look at the 5 minute SPY. After breaking below the white uptrend line yesterday, the SPY popped above R2 on the strongest ISM Non-Mfg Index reading in years, yet the SPY quickly faded back to R2 & is only trading slightly positive on such bullish news. That latest push higher put additional divergences in place and has now formed a bearish rising wedge pattern (yellow lines) which may or may not need one additional thrust higher. The intraday charts have proven difficult to trade in this low volume, HFT driven market but figured this would be worth keeping an eye on.

Nothing new to report on the longer-term charts (daily & weekly) other than the fact that the $SPX death cross remains in place despite another up day in the index so here’s a quick look at the 5 minute SPY. After breaking below the white uptrend line yesterday, the SPY popped above R2 on the strongest ISM Non-Mfg Index reading in years, yet the SPY quickly faded back to R2 & is only trading slightly positive on such bullish news. That latest push higher put additional divergences in place and has now formed a bearish rising wedge pattern (yellow lines) which may or may not need one additional thrust higher. The intraday charts have proven difficult to trade in this low volume, HFT driven market but figured this would be worth keeping an eye on.

Overall, my current bias remains short equities, long select fixed income & high-yield CEF’s, and I’m still out of all precious metals and mining stocks at this point as I just don’t yet see an objective re-entry on those trades at this point in time.