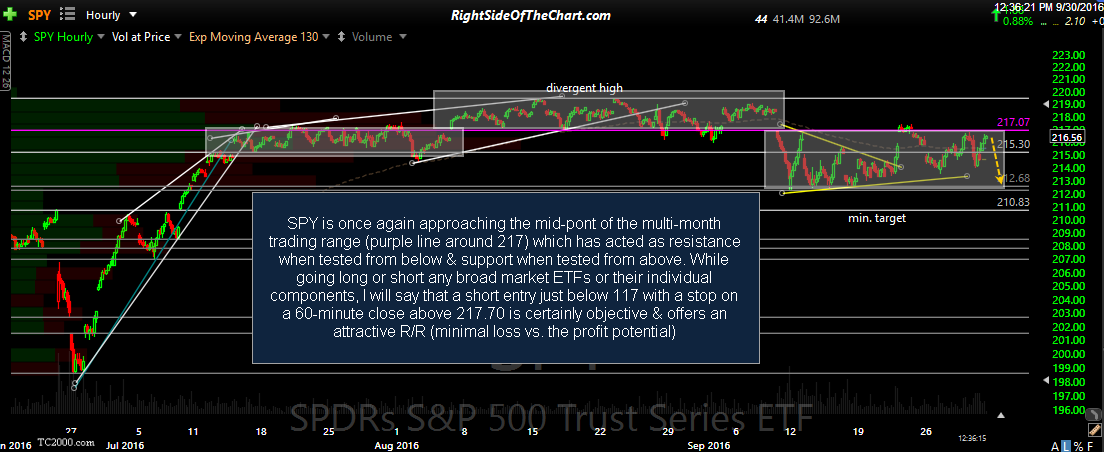

SPY is once again approaching the mid-point of the multi-month trading range (purple line around 217) which has acted as resistance when tested from below & support when tested from above. While going long or short any broad market ETFs or their individual components for anything other than a quick 1-2 day trade still runs an elevated risk of the trade failing due to the choppy, sideways range the market has been trading in lately, I will say that a short entry just below 117 with a stop on a 60-minute close above 217.70 is certainly objective & offers an attractive R/R (minimal loss vs. the profit potential). The shaded boxes highlight how the SPY tends to trade above or below the 217 level once it final makes a convincing break above or below.

My own preference right now is to continue to focus on trading stocks with a little-to-no correlation to the broad market until we have a definitive resolution of the multi-month sideways trading range that the US equity market has been grinding around in. Updates were posted to a couple of those stocks (unofficial trades) in the trading room today including CANN, which just hit the final target for a 150% in just 16 trading sessions since triggering a breakout above the downtrend line as well as ACPW, another low-priced stock with a near-zero correlation to the broad market. The ACPW trade setup was highlighted in yesterday’s trade idea video & broke out today, gaining 100% & hitting both price targets before coming back into for a backtest of the wedge (and may offer another objective entry here).