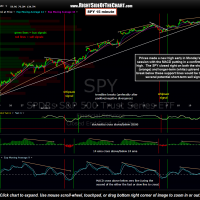

As a follow-up to Friday’s video discussion of the SPY, so far the preferred scenario seems to be playing out. The SPY gapped up at the open, rallied in the morning to put in a new higher high in prices and then faded in the afternoon to close below the morning highs. In addition, that negative divergence that was forming was also confirmed today via the bearish crossover on the MACD (MACD line crossing below 9 ema signal line, which officially put in a lower high).

Interestingly, prices closed right on both the shorter-term uptrend line as well as the longer-term uptrend line discussed in the video. Therefore, prices still remain in a confirmed uptrend pending a cluster of the recently discussed 15 minute sell signals (trendline break, 14-34 ema cross, MACD zero line cross and stochastics cross below 80), all of which remain on buy signals for now but are not far from their respective triggers. The second chart below is also a 15 minute SPY chart which simply shows the effectiveness of using divergences on the MACD to warn of impending corrections.