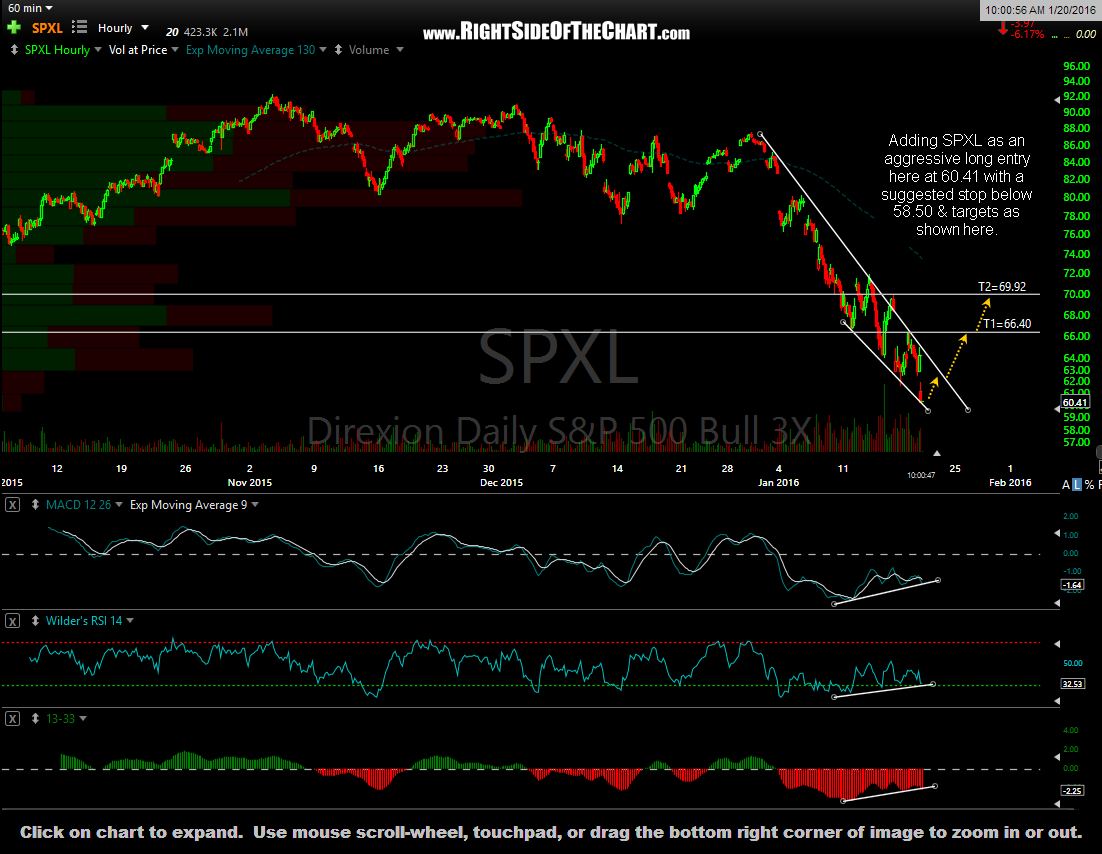

SPXL (3x bullish S&P 500 ETF) will be added as an aggressive long entry here at 60.41 with a suggested stop below 58.50. T1 is 66.40 & T2 (the final target) is 69.92. Of course, one could also use any of the $SPX tracking vehicles such as SPY (1x/non-leveraged $SPX ETF), SSO (2x leveraged bullish $SPX ETF), ES ($SPX e-mini futures) or short SPXS (3x bearish $SPX ETF), depending on your preference.

I chose SPXL as the preferred proxy for this aggressive, counter-trend trade for a few reasons. First, I believe that the critical support levels, the bottom of which both the $NDX & $SPX are currently testing, will hold, even if briefly exceeded on an intraday basis, producing at least a tradeable bounce lasting several days or more. I also believe that if I am wrong and the markets slice right through this support & are headed down to the next targets discussed in the recent US Equity Index video, then the $SPX, which is comprised of many dividend paying stocks, defensive stocks such as ultilties as well as a large weighting in the already beaten down energy sector, is likely to fall “less” than the tech & biotech heavy $NDX.

To be very clear, although this trade offers an attractive R/R profile (based on the suggested stop relative to either profit target) this is an aggressive, counter-trend. As always, trade according to your own objectives, risk tolerance & trading style.