I just wanted to reiterate the recent bullish price action & potential upside remaining in one of my favorite sectors, the Specialty & Generic Drug Manufacturers. Unfortunately, (to the best of my knowledge) there isn’t an ETF that specifically targets this sub-sector of the pharmaceutical industry hence the reason that I posted this video covering approximately 3 dozen of the most promising trade ideas within the sector 10 days ago.

In lieu of another video, in which I would basically be covering the same companies, I figured that I would post some of the updated charts below. Many of the stocks covered in that video have gained well into the double digits since such as ENDP, which gained 45% in the following 3 trading sessions from where it was highlighted in that video and MNK also gaining nearly 50% since then. Many of those stocks have since triggered buy signals on breakouts above the key levels with many others that had were already offering objective long entries continuing to build on those gains yet some other that close to triggering buy signals. Here are a few of the charts that still look compelling at this time although this list is far from inclusive.

HROW still offers an objective entry on this uptrend line with the stock also breaking out above the downtrend line/triangle pattern.

OPTN has gained 10% since highlighted in the recent video as it continues to form the right shoulder of an IHS bottoming pattern.

MNTA starting to break above the 15.00 resistance/buy trigger level.

ENDP gained 45% over the next 3 sessions from where it was highlighted in the recent video just 10 days ago.

COLL is +6% today, triggering the buy signal on this impulsive breakout above the downtrend line today.

MNK has already gained as much as 48% from where it was highlighted just 10 days ago & still looks to have more room to run.

APHA still appears to have another 15%+ upside following the recent breakout & backtest.

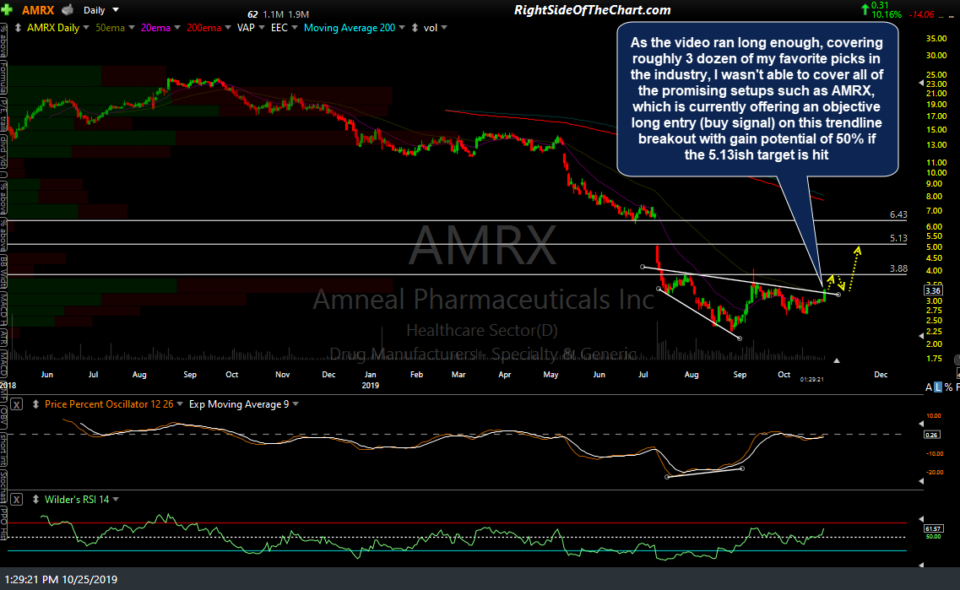

As the video ran long enough, covering roughly 3 dozen of my favorite picks in the industry, I wasn’t able to cover all of the promising setups such as AMRX, which is currently offering an objective long entry (buy signal) on this trendline breakout with gain potential of 50% if the 5.13ish target is hit.