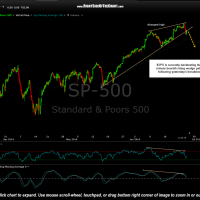

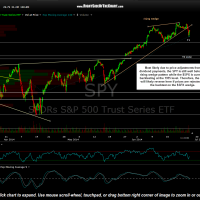

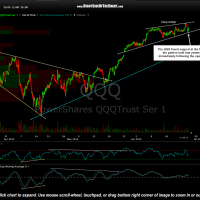

$SPX is currently backtesting the 60 minute bearish rising wedge pattern following yesterday’s breakdown while the SPY, most likely due to price adjustments from dividend payments, is still well below its rising wedge pattern. Therefore, the SPY will likely reverse here if prices are rejected off the backtest on the $SPX wedge. Meanwhile, QQQ found support at the bottom of the pattern both late yesterday & immediately following the open today. As mentioned yesterday, a break below the 60 minute wedge on the Q’s would be an additional near-term sell signal & greatly increase the chances of a correction in the US markets.

- $SPX 60 minute June 25th

- SPY 60 minute June 25th

- QQQ 60 minute June 25th