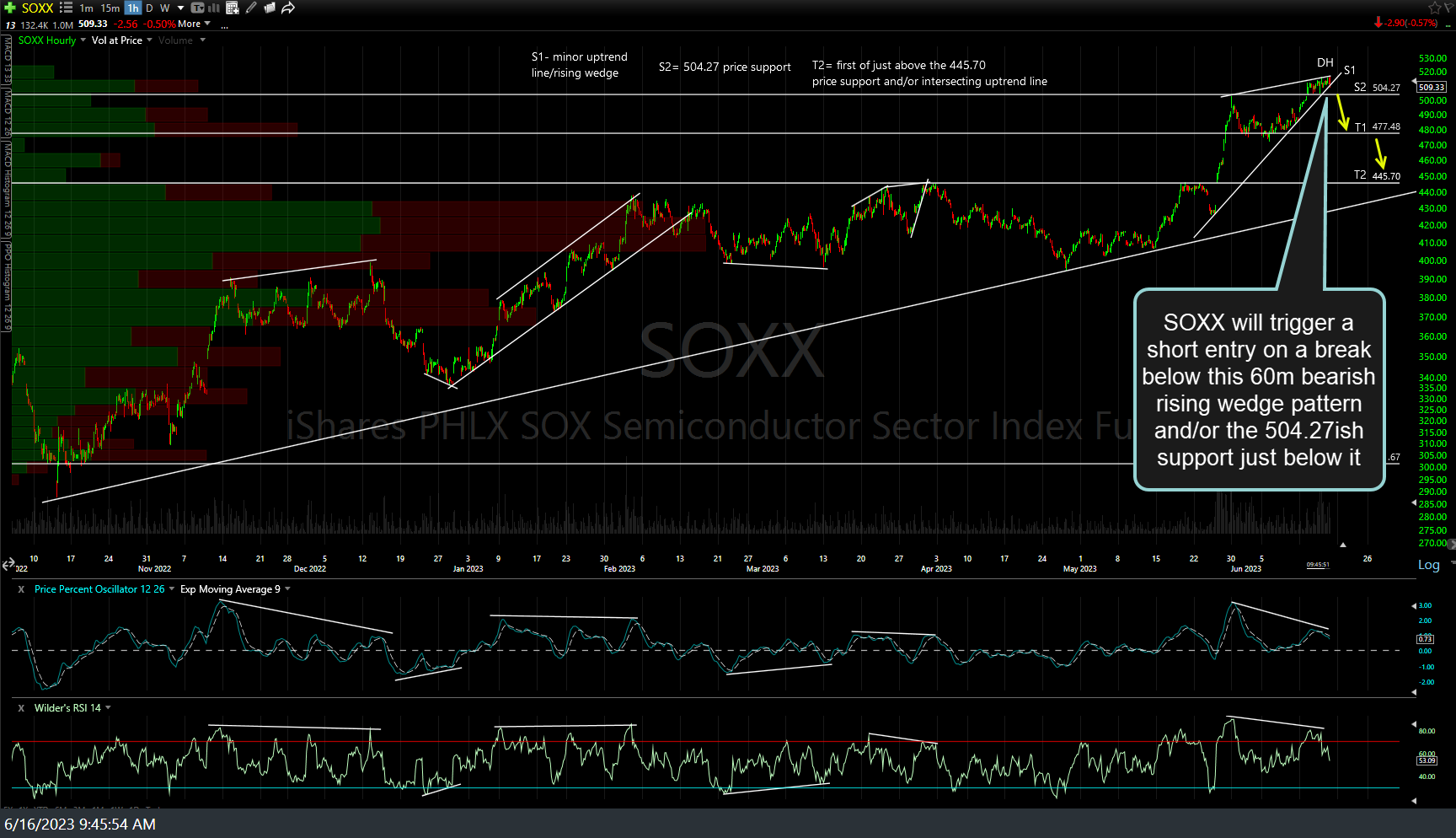

SOXX (semiconductor sector ETF) will trigger a short entry on a break below this 60-minute bearish rising wedge pattern and/or the 504.27ish support just below it.

The first price target is just above the 477.48 support with a current second & final price target just above the first of the 445.70 support or the larger uptrend line should roughly intersect that level if/when that ~12% price target is hit. Additional targets may be added if & when A) an entry is triggered and B) depending on how the charts of both the semis as well as the broad market develop going forward.

Max. suggest stop (if targeting T2) would be 545 (a ~6% stop allowance or 2:1 R/R), or lower depending on one’s preferred R/R. The suggested beta-adjusted position size would be ~0.7-0.8% with the appropriate downward adjusted to account for the leverage factor if any of the leveraged & inverse ETFs such as SOXS (-3x semis) is used. Of course, this is a counter-trend trade so pass if it does not mesh with your outlook, risk tolerance, or trading style.