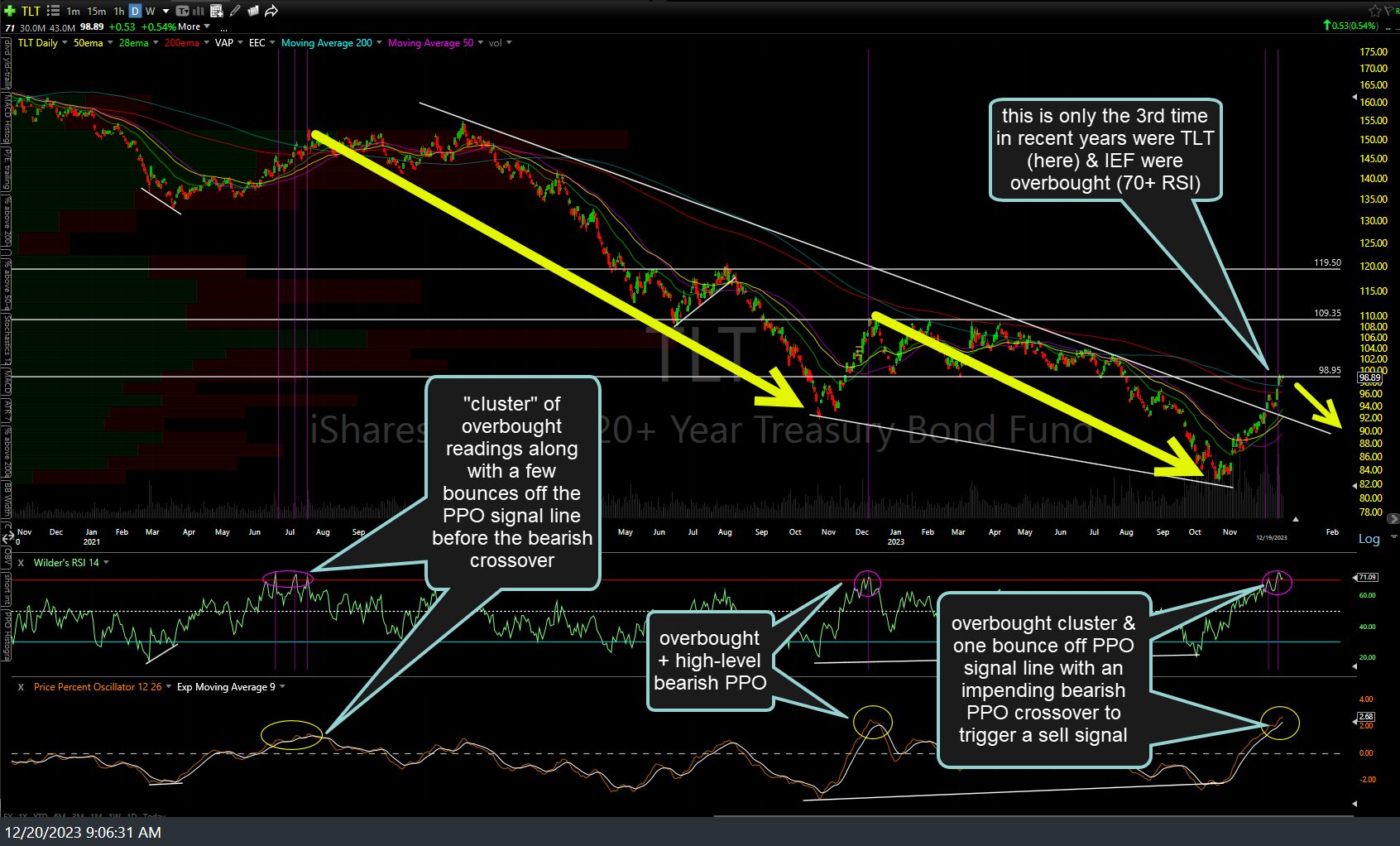

Upon further review of the charts, I’ve decided to sit tight on the TLT swing trade vs. using a stop over yesterday’s highs. As of the close, the TLT short swing trade is only down a hair over 3% & based on the technical posture of TLT (20-30 yr Treasury bond ETF) & IEF (7-10 yr) below, it appears to be prudent to give this one a little more room, especially if holding out for any of the lower price targets (with the potential for additional targets to be added, depending on how the technicals develop going forward.

This is only the third time in recent years where both TLT & IEF were oversold (RSI 70+) with each of the previous overbought readings either followed by an immediate trend reversal or a top with sideways trading which was then followed by a (bearish) trend reversal. Those overbought readings were either one-and-done or in a cluster of two or three overbought readings in close proximity, with the nail in the coffin coming once the PPO made a high-level bearish crossover (which was shortly after the overbought readings).