/SI (silver futures) has rallied over 7% from the June 27th entry into the 2387.24 price target/resistance an objective opp to book profits or raise stops to protect gains if holding out for more upside. Previous & updated 60-minute charts below.

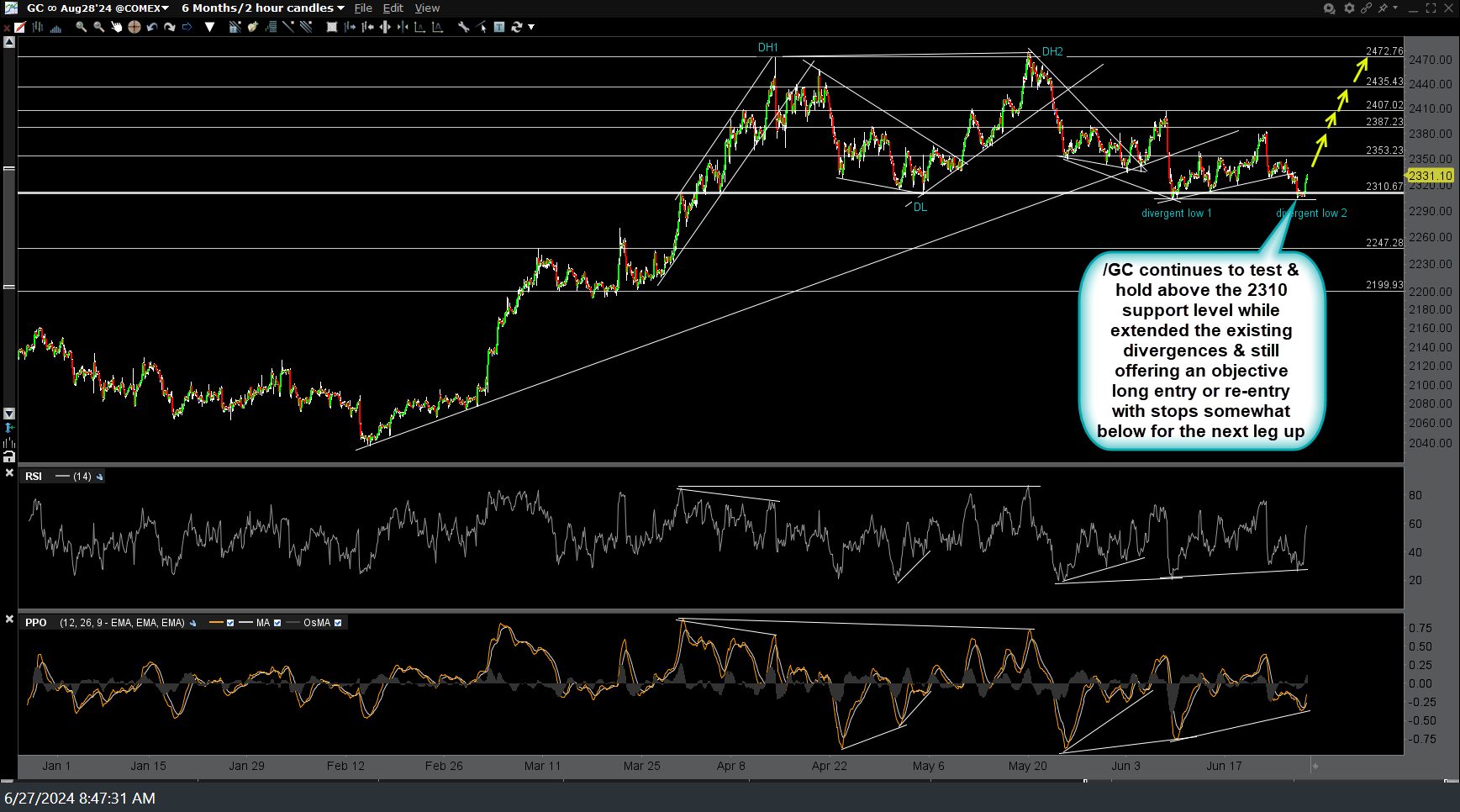

Likewise, /GC (gold futures) is also at the comparable 2387.24 price target/resistance an objective opp to book profits or to raise stops to protect gains if holding out for more upside. Previous (June 27th) and updated 60-minute charts below.

GDX is also trading at the upper-most bounce target from June 16th update I fired off while on vacation, suggesting to cover the current GDX short for 9% profit and/or reverse to long based on GLD hitting its final price target at that time. June 16th & updated 60-minute charts below.