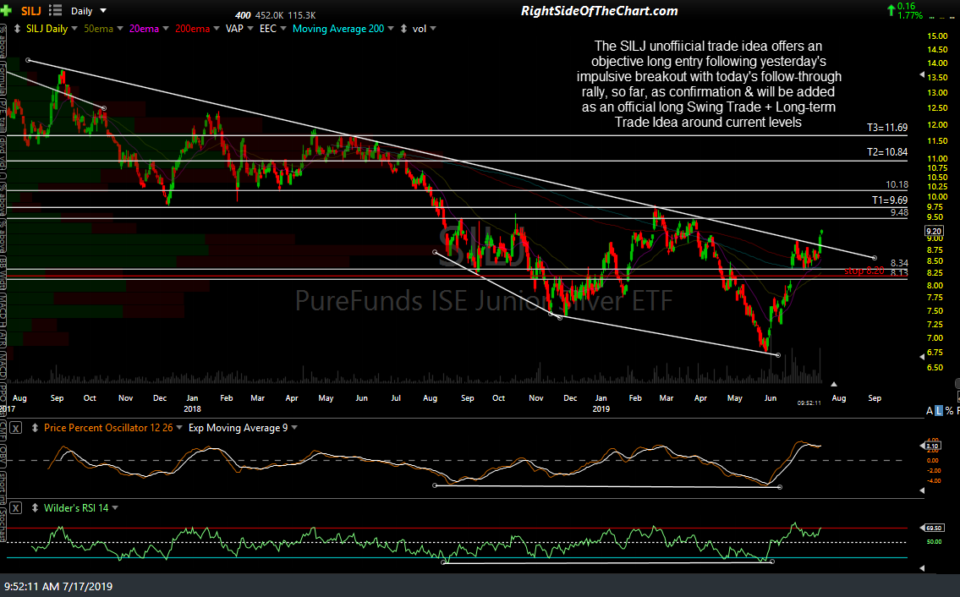

The SILJ (Junior Silver Miners ETF) unofficial trade idea offers an objective long entry following yesterday’s impulsive breakout with today’s follow-through rally, so far, as confirmation & will be added as an official long Swing Trade + Long-term Trade Idea around current levels.

The price targets are T1 at 9.69, T2 at 10.84 & T3 at 11.69 with the potential for additional targets to be added, depending on how the charts of the precious metals & mining stocks develop going forward. The suggested stop for this trade is any move below 8.20 (about ½ way down the big June 20th gap) and the suggested beta-adjusted position size for this trade is 0.80.

Some considerations for this trade:

- Keep in mind that SILJ in a fairly thinly traded ETF and as such, consider using limit orders (splitting the bid & ask price, moving closer to the ask price if not filled in a reasonable amount of time) or other orders intended to provide an optimal fill, such as Interactive Broker’s IBalgo orders (which fish around the order using an adaptive algo attempting to get the best fill for your entry) & as always, a standard limit order (GTC) for you closing trade at your preferred price target(s).

- I will likely be adding additional precious metals related trade ideas as official, such as gold, silver, GDX and/or SIL (Silver Miners ETF) and possibly some individual mining stocks if the bullish case continues to firm up. Regardless of the trade ideas that are posted on this site, one should first determine how much of their overall investment portfolio and/or trading account they intend to allocate to a certain sector or related trade, such as the precious metals & related mining stocks, in order to determine how much to take in each position if they plan to scale in or gradually build/increase exposure to a certain trade. e.g- If you currently plan to take up to a $50,000 exposure to the PM’s & mining stocks and you plan to do so via 5 different ETFs such as GLD, SLV, PPLT, GDX & SIL, then you might target +/- $10k in each of those positions.