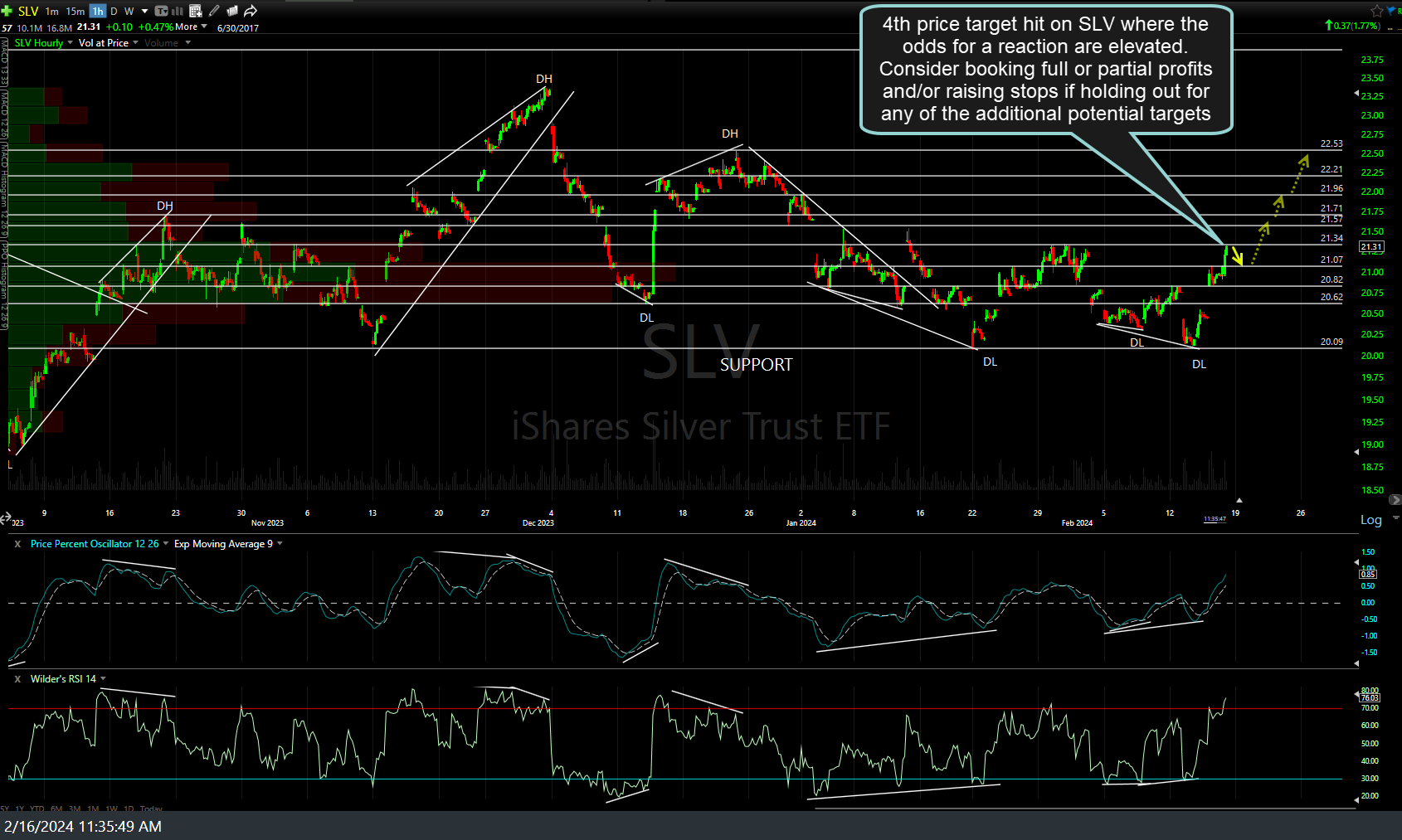

The forth price target has just been hit on the SLV (silver ETF or /SI, silver futures) swing trade where the odds for a reaction are elevated. Consider booking full or partial profits and/or raising stops if holding out for any of the additional potential targets. Previous & updated 60-minute charts below showing the multiple objective entry & exit points for both active & swing trader over the past week or so.

As you can see from the solid & then dotted (& lighter in color) arrows on the original chart, this 21.34ish resistance was & still is my “preferred” swing target. While I do think the odds for a reaction here are elevated at this time, I don’t have very strong convictions on if or how much silver will pull back from here or if & how much it will continue higher.

As such, those bullish & holding out for additional upside could simply raise stops to protect profits & let the position ride. Likewise, active traders might opt to book profits on their long position and/or reverse to short in attempt to game a pullback off the initial tag of this resistance/target level with a minimum pullback target just above the 21.07 support/former T3 level or let it run with a trailing stop (or periodically ratcheting down stops).