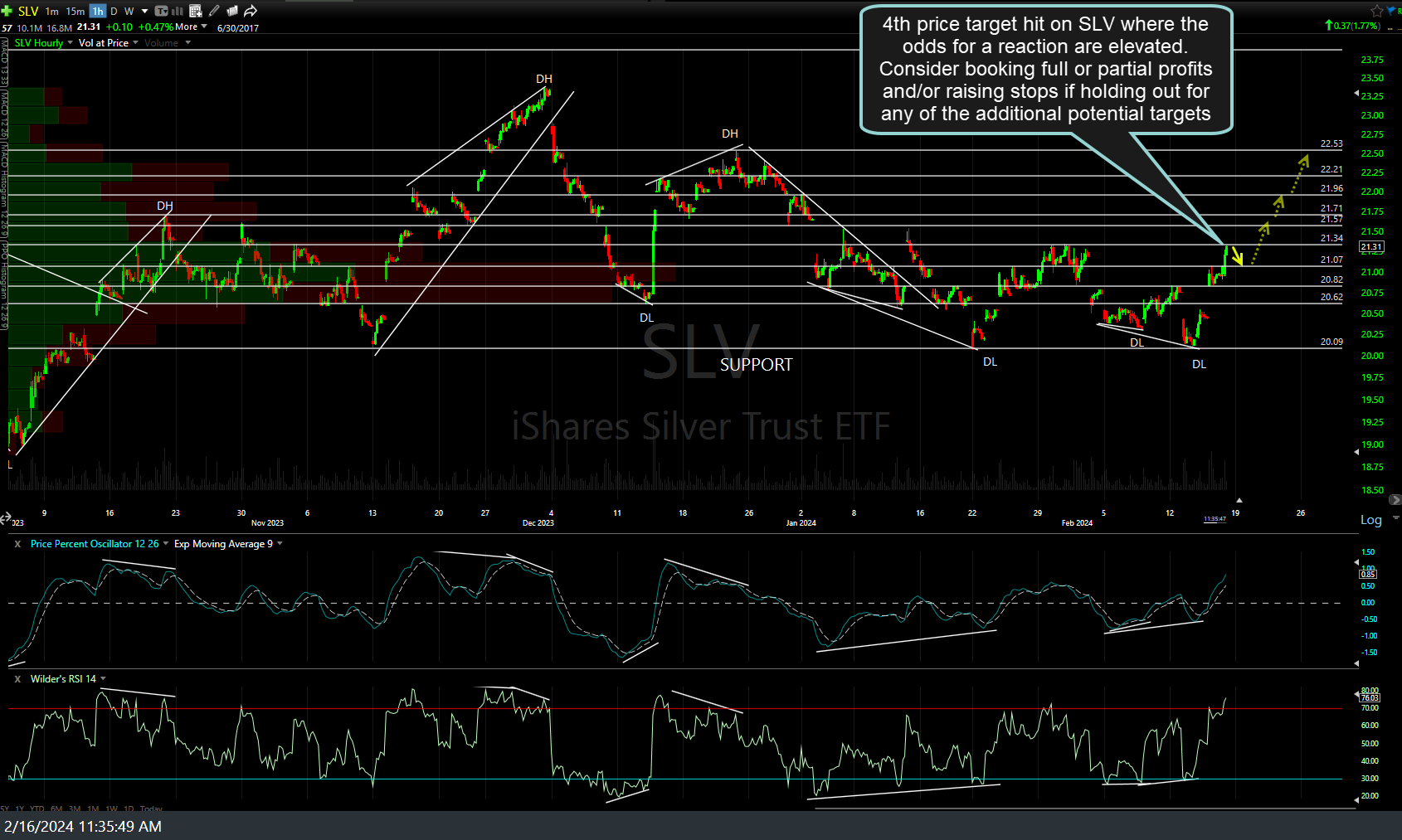

Closing the SLV (silver ETF or /SI sliver futures) swing trade early as it has just hit the 21.21 target/resistance with negative divergences forming on the 60m chart, thereby increasing the odds of a substantial pullback. Consider booking profits or raising stops if holding out for the previous final target of 22.53.

Basically, I don’t think the R/R is favorable for holding out for the extra 1% or so up to the 22.53 final target & risking a sudden reversal with this trade already up 9-11% from the initial buy zone. Of course, one could ratchet up or trail stops at this point but that works better on /SI silver futures, which trade around the clock, vs. the silver ETF, which is prone to potentially large opening gaps that can bypass the most well-placed stop loss orders.

Waiting for the next objective entry, long or short & will keep the GDX & SIL (gold & silver miners ETFs) trades active for the time being as those charts still appear constructive but consider raising stop to protect profits, should gold & silver reverse soon. Previous & updated 60-minute charts of SLV below.