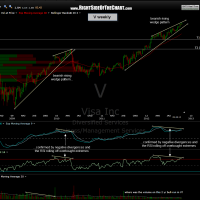

i am adding V as an active short trade here at current levels at the top of this large rising wedge. keep in mind that my own personal trading style is what i refer to as an “anticipatory trader”, meaning that i will often enter a trade in anticipation of a pattern breakdown or trend reversal, before it actually happens. this strategy can obvious cut both ways and is a more aggressive style of trading. more conservative or conventional traders might consider waiting for V to make a confirmed breakdown below this rising wedge pattern. another option would be to short a 1/2 position here at the top of the wedge (with the appropriate stops in place, of course) and adding the 2nd lot once/if prices make a confirmed breakdown below the bottom of the wedge pattern.

i have listed targets on both the daily and weekly charts as more active traders might prefer trading off the daily charts while longer-term swing trader might use the weekly charts. as always, one’s stops should be commensurate with the price level that you are targeting for the trade. my preference is to use at least a 3:1 R/R ratio (risking $1 of loss for every $3 of profit at a minimum).