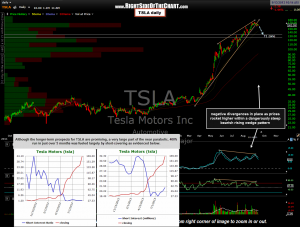

Yes, I’m adding the “untouchable” TSLA as an active short trade. I personally shorted TSLA (along with the previously posted Z) late last week just inside the wedge in anticipation of a breakdown. Prices are still basically around where took the initial position and I plan to add only if both TSLA and the broad market begin to move lower from current levels. TSLA did break below the wedge on Monday and as prices have basically moved sideways since, the stock still offers and objective entry around current levels with a suggested stop over the recent highs.

Yes, I’m adding the “untouchable” TSLA as an active short trade. I personally shorted TSLA (along with the previously posted Z) late last week just inside the wedge in anticipation of a breakdown. Prices are still basically around where took the initial position and I plan to add only if both TSLA and the broad market begin to move lower from current levels. TSLA did break below the wedge on Monday and as prices have basically moved sideways since, the stock still offers and objective entry around current levels with a suggested stop over the recent highs.

This trade current has only one target zone (T1 zone). Target zones are used when there is a relative tight range of support where a bounce is likely to occur vs. a single price level. A TSLA short should be considered an aggressive, counter-trend trade and my preferred strategy is to use a below average position size for the trade to account for the above average expected volatility and profit/loss potential on the trade. I’ve overlaid the tremendous plunge in both short interest and the short interest ratio (days-to-cover). The short interest ratio in this stock has fallen from a whopping 44 to a mere 1.8 days-to-cover in just under 12 months, indicating that a significant portion of the near-parabolic, 400%+ run over the last 5 months was largely fueled by short-covering.