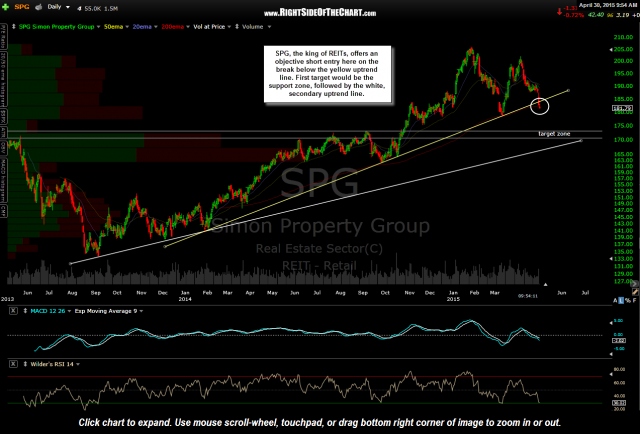

SPG (Simon Property Group), the king of REITs, offers an objective short entry here on the break below the yellow uptrend line. First target would be the support zone, followed by the white, secondary uptrend line.

SPG is the largest holding in IYR (iShares US Real Estate ETF) and with most REITs poised for a correction, more aggressive traders only looking for a short-term trade lasting hours or days could opt to use SRS (2x short real estate etf) or DRV (3x short real estate etf). I’ll try to follow up with an exact suggest profit target (buy-to-cover) level or levels as well as suggested stops on SPG.

Another potentially lucrative option for swing traders consider a multi-week or even multi-month short on the REITs would be to short DRN (3x long real estate etf). Should the REITs correct over the next several weeks+, as I expect, one would benefit from both the price drop in the sector as well as the price decay due to the 3x leverage on DRN.