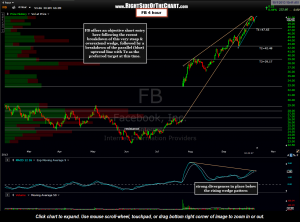

FB will be added as an Active Short Trade here around the 50.45 area. On Sept 13th, Facebook broke below this very steep & overextend wedge & proceeded to backtest the wedge from beneath while forming an ascending channel with the parallel (blue) uptrend line. Prices have now broken below that channel with the MACD poised to make a bearish crossover, thereby confirming the divergence put in place on the recent highs. T2 (42.48) is the preferred target at this time with T3 (39.17) as the current final target. Stops should be determined based on one’s preferred target, using no less than a 3:1 R/R (risk to reward ratio). Most trade ideas on RSOTC list multiple price targets to accommodate various trading styles. Using this FB short trade as an example, a very active trader might only target T1 looking to book a quick, relatively modest 5.5% on a trade that is expected to last anywhere from a couple of days to less than two weeks while a typical swing trader who is bearish on both FB & the broad market in the short & intermediate-term might prefer to hold out for T3 with an expected holding period of a few weeks to a couple of months, possibly booking partial profits or even reversing the trade (short to long for a quick bounce) at T2. Targets are listed on this 4-hour chart.

FB will be added as an Active Short Trade here around the 50.45 area. On Sept 13th, Facebook broke below this very steep & overextend wedge & proceeded to backtest the wedge from beneath while forming an ascending channel with the parallel (blue) uptrend line. Prices have now broken below that channel with the MACD poised to make a bearish crossover, thereby confirming the divergence put in place on the recent highs. T2 (42.48) is the preferred target at this time with T3 (39.17) as the current final target. Stops should be determined based on one’s preferred target, using no less than a 3:1 R/R (risk to reward ratio). Most trade ideas on RSOTC list multiple price targets to accommodate various trading styles. Using this FB short trade as an example, a very active trader might only target T1 looking to book a quick, relatively modest 5.5% on a trade that is expected to last anywhere from a couple of days to less than two weeks while a typical swing trader who is bearish on both FB & the broad market in the short & intermediate-term might prefer to hold out for T3 with an expected holding period of a few weeks to a couple of months, possibly booking partial profits or even reversing the trade (short to long for a quick bounce) at T2. Targets are listed on this 4-hour chart.

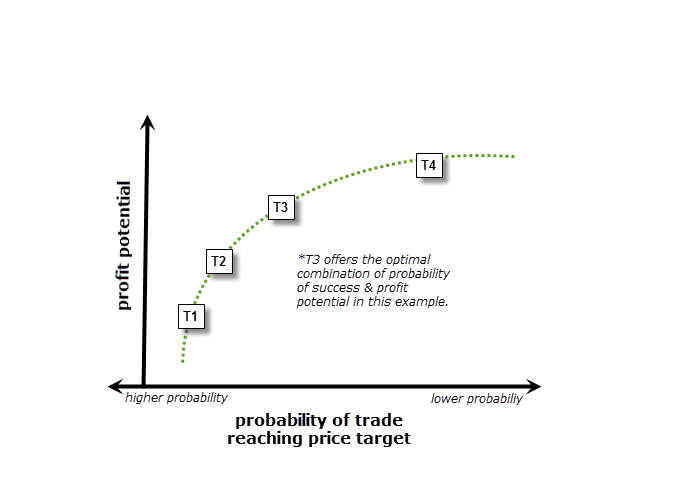

Although all profit target posted on the trade ideas have a good chance of being hit based on my analysis of the chart, I view targets this way: Logically, the lower the target (numerically, e.g.- T1, T2, etc…) the better chance it has of being hit, as that level is closest to the current price. However, the final target, although having a lower probability of being hit, still has a relative good chance based on my interpretation of the technicals along with other factors such as the outlook for the broad market, current sentiment & short-interest measures, etc… Typically the final target is set at a level in which the R/R is no longer clearly favorable to remain in the trade and therefore I will book profits on any and all shares that I might still own. A preferred target, which is often mentioned on a trade, is the level where the current “sweet spot” on the R/R curve is at the time, as illustrated in this example (chart).