Shorting ERX (3x long energy sector etf) here just below gap resistance with a stop slightly above 69.10. Most likely pullback target is the 63ish area although I may extend the target. ERX will be added as an Active Short Trade although some brokers might not have shares available to short, in which case DUG (2x short oil & gas/energy sector etf) or XLE (1x long energy sector etf) could also be used. Specific target(s) and stop(s) to follow.

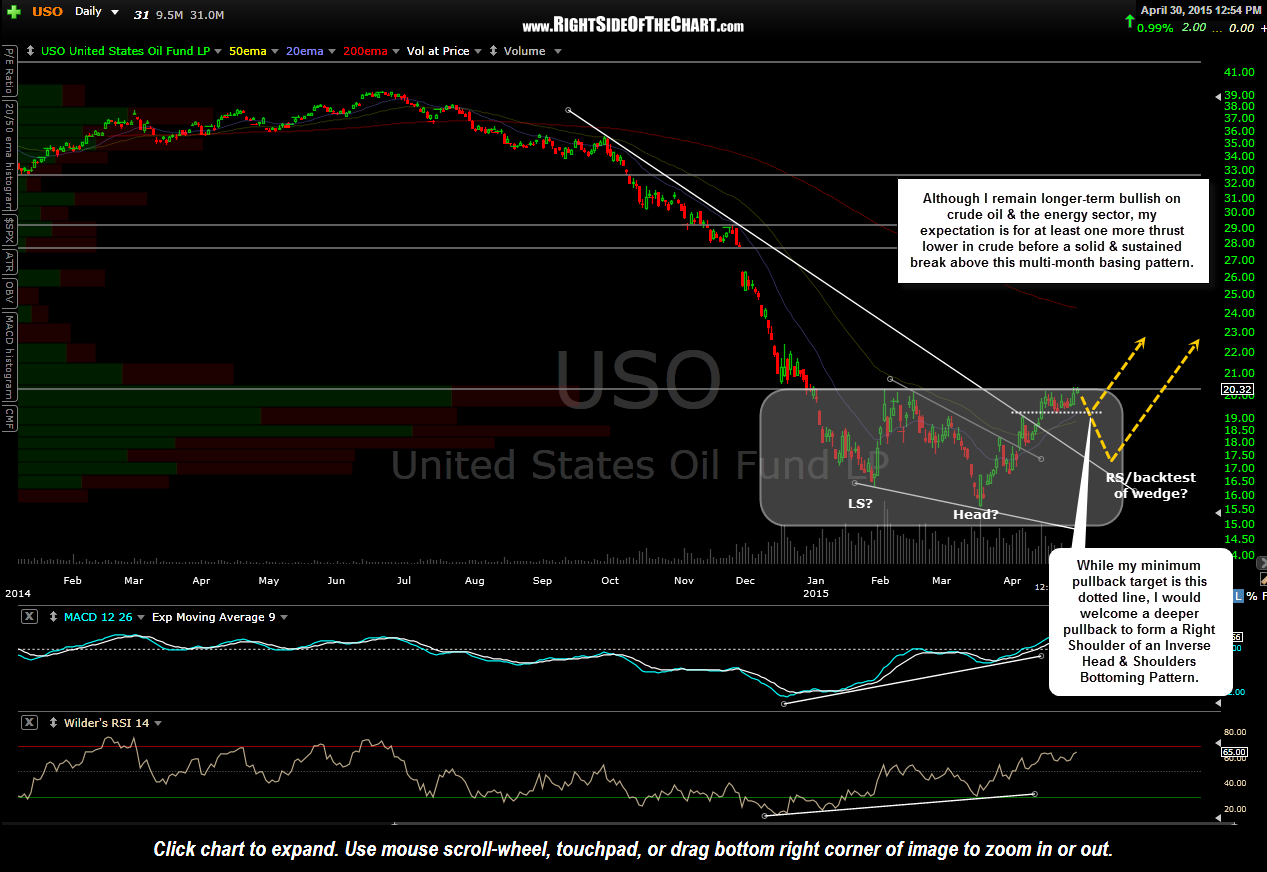

Although my current plan is to attempt to trade the initial pullback from the current resistance level that crude oil is trading at (top of the large basing pattern), I may allow this short trade to morph into a multi-week or even multi-month swing trade, depending on what I see in the charts going forward. As such, I have decided to use ERX in order to capture both a move down in the energy stocks (which is likely to occur if the broad market continues lower AND crude oil prices reverse trend) as well as taking advantage of the price decay that occurs over time in leveraged etfs. When trading a leveraged etf, I always adjust my position size accordingly (e.g.- ERX would be about 1/3 of the position size of an XLE short trade).