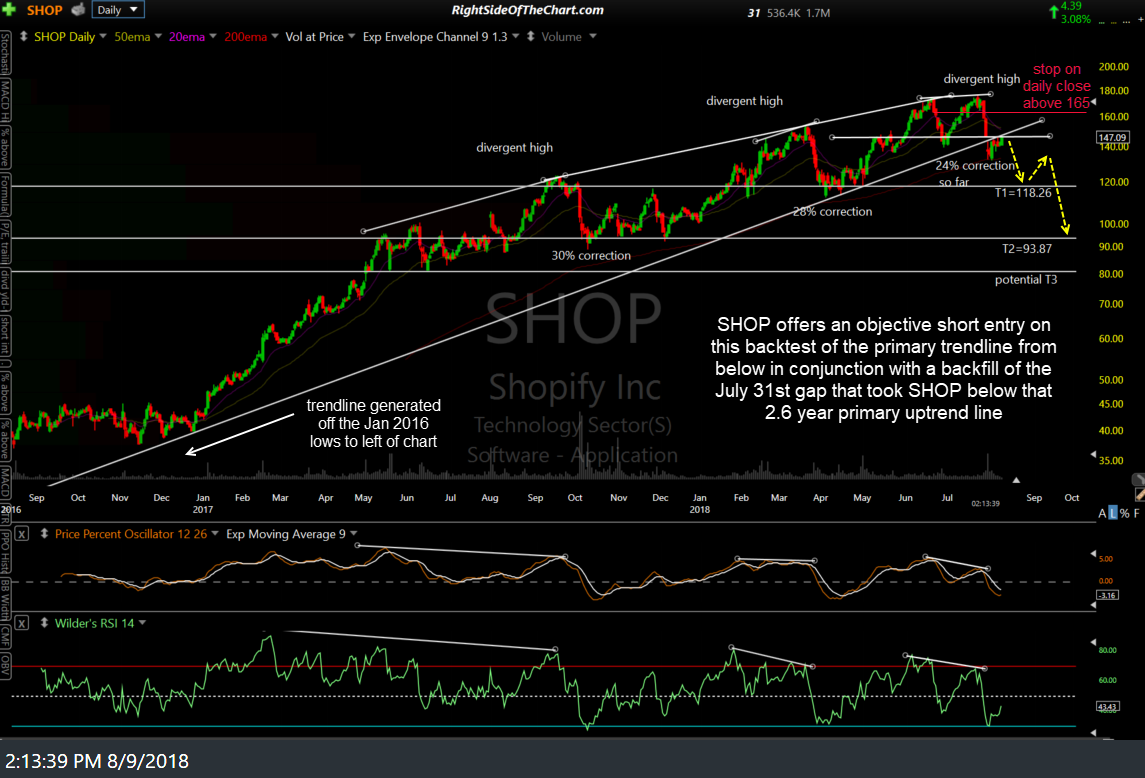

SHOP (Shopify Inc.) offers an objective short entry on this backtest of the primary trendline from below in conjunction with a backfill of the July 31st gap that took the stock below that 2.6-year primary uptrend line (see 4-year chart below for entire trendline).

- SHOP daily Aug 9th

- SHOP 4-year Aug 9th

The recent trendline break comes on the heels of the third divergent high in SHOP over the past year with the previous two DH’s followed by corrections of 30% & 28%. Not only is this most recent divergent high simply an extension of those previous divergences, which has formed much larger divergences with longer-term bearish implications, but this time around the stock has broken down below that multi-year primary uptrend line, which could have longer-term bearish implications as well, with the potential for another 36% -45% downside from current levels in the coming months+.

The price targets for this trade are T1 at 118.26 & T2 at 93.87 with a potential third price target to be added around the 80 level, depending on how the charts of both SHOP & the broad market develop going forward. The maximum suggested stop for this trade is a daily close above 165.00 (lower, if only targeting T1) with a suggested beta-adjusted position size of 0.90.