Here are a few of my top picks for sector ETFs right now that appear to offer some of the best risk-to-reward profiles at this time. Holding exchange traded products (ETFs & ETNs) vs. individual stocks during earnings season helps to mitigate the risk of being caught on the wrong side of a large earnings-induced gap against your position (e.g.- INTC has traded up over 10% today following their earnings report last night while SOXX has only traded up less than 2½% so far today).

SOXX – semiconductors ETF short (or SOXS long). This backtest of the recent broken 60-min uptrend line on SOXX (from the INTC earnings pop) offers an objective add-on or new short entry.

- SOXX 60-min Jan 26th

- SOXX daily Jan 26th

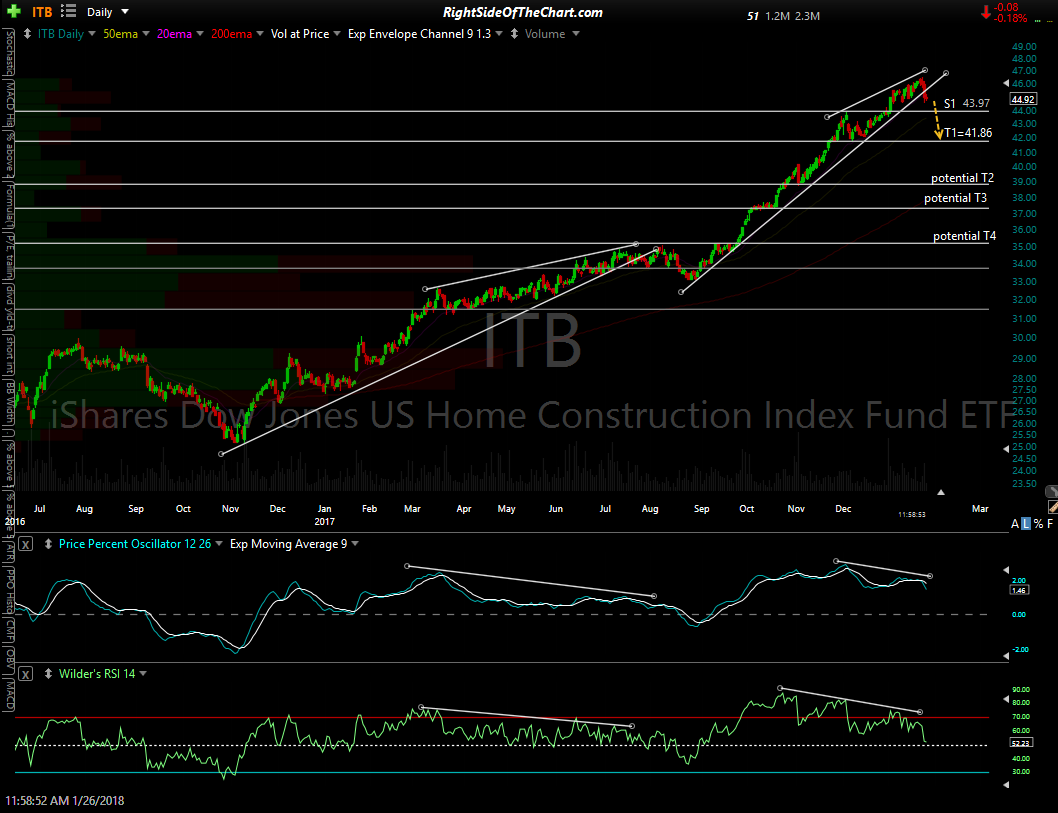

ITB – US home construction Index ETF:

XLE – energy sector ETF (or XOP, XES, ERY or DUG):

- XLE daily Jan 26th

- XLE 60-min Jan 26th

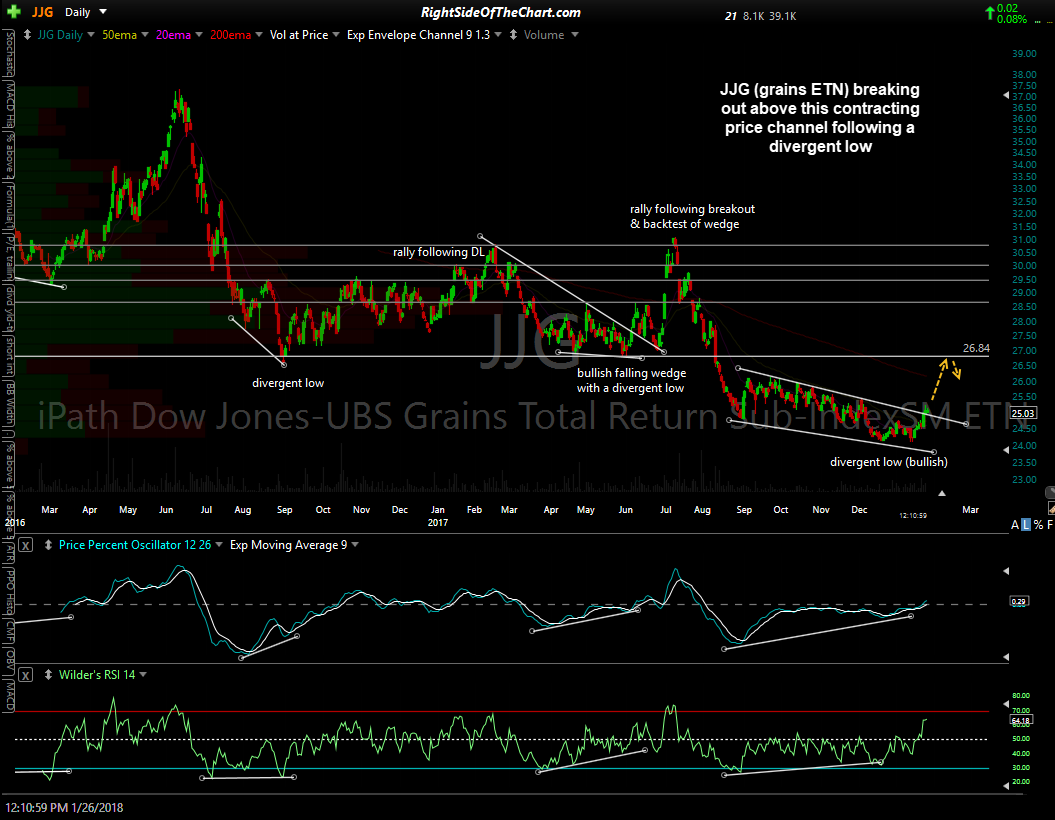

JJG – Grains ETN (comprised of Corn (CORN) 45%, Soybeans (SOYB) 35%, Wheat (WEAT) 21%: