IWM (Russell 2000 Small-cap ETF) has fallen to uptrend line support in the pre-market session with price support just below.

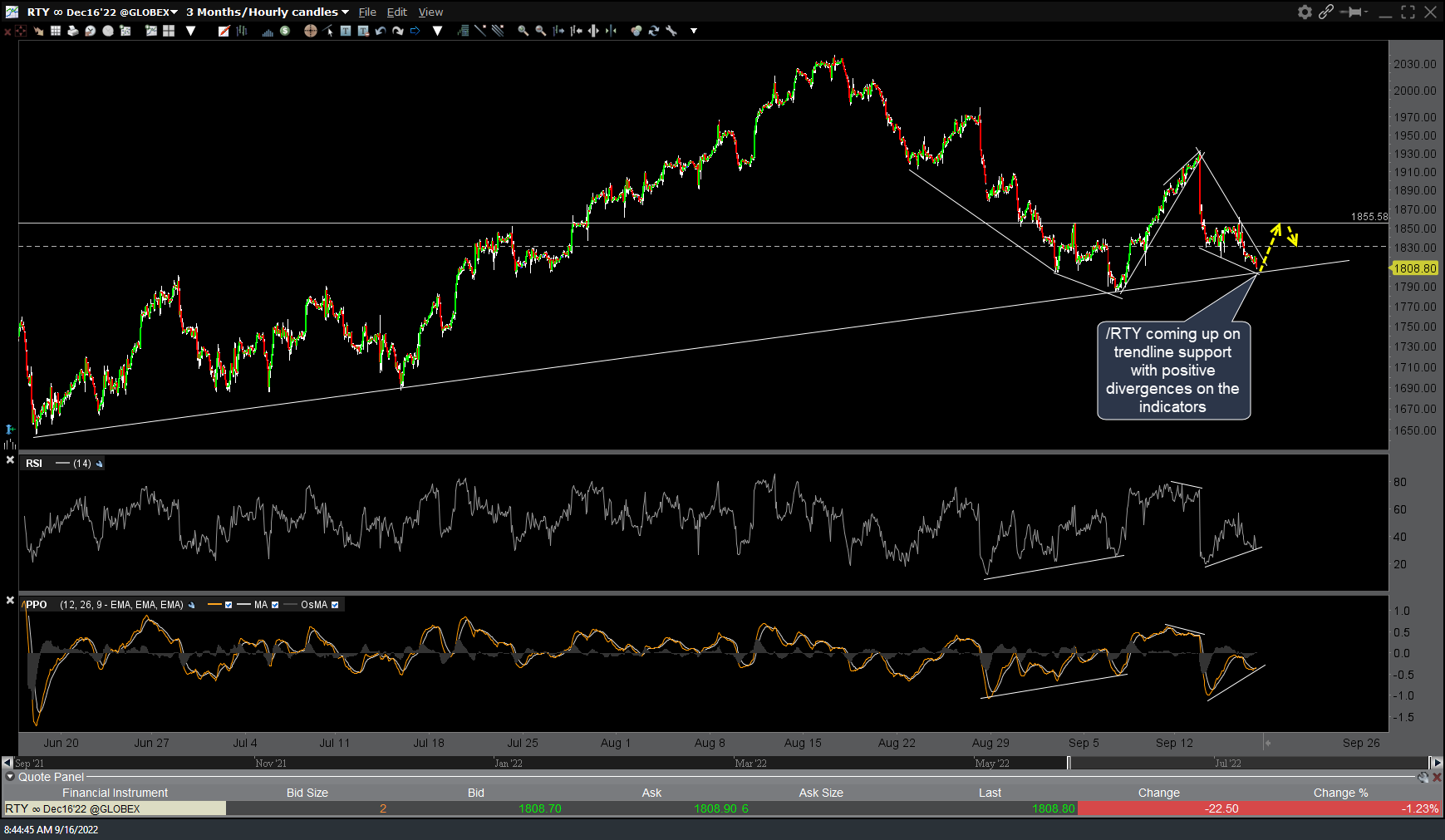

Likewise, /RTY (R2k futures) is also coming up on trendline support with positive divergences on the indicators. While I continue to favor more downside in the equity indices in the coming days to weeks, a case can be made for an aggressive, counter-trend trade for a long position in /RTY or IWM here with stops somewhat below the 178ish price support level on IWM & 1800ish price support on /RTY. Potential bounce targets shown with the arrows on these 60-minute charts …and yes; In order for the small-caps to bounce and/or hit that target, the large-caps ($SPX & $NDX) will most likely have to rally today as well and at the moment, all US stock indices are solidly entrenched in a downtrend with zero signs of a reversal at this time. Hence, the reason this would be considered an aggressive, counter-trend trade. This would also be an objective level for active traders to either book full or partial profits on a short position and/or lower stops.