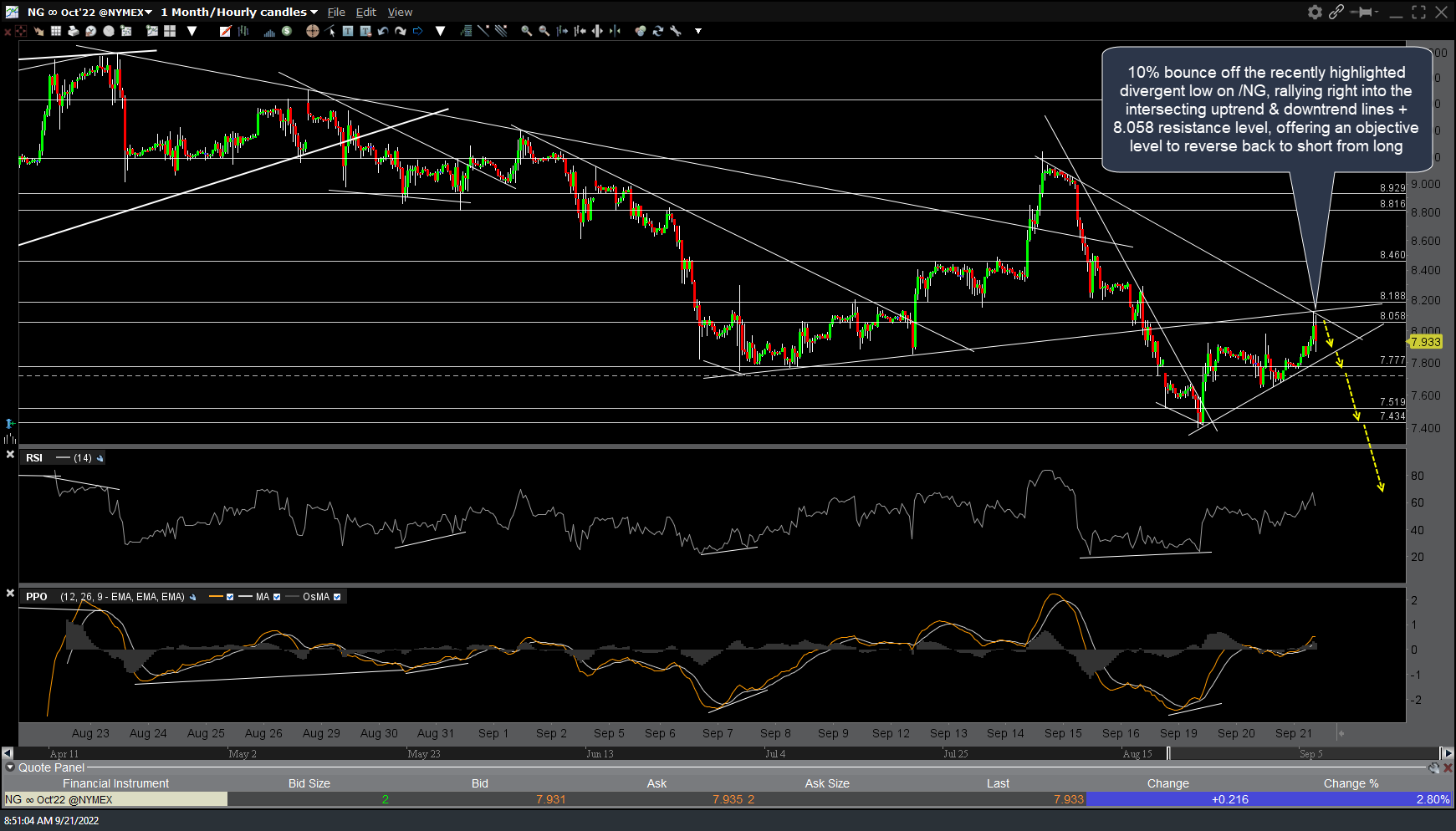

Since this post making the case for a tradable bounce in natural gas on Monday, /NG (natural gas futures) has made a 10% bounce off the recently highlighted divergent low, rallying right into the intersecting uptrend & downtrend lines + 8.058 resistance level, offering an objective level to reverse back to short from long. Previous (Monday’s) and updated 60-minute charts below.

Likwise, UNG (natural gas ETN) was trading at the 25.86 support/target in the pre-market session on Monday when the cover short/go long bounce trade idea was posted (first chart below) with that bounce long trade (and cover short) good for about 9% so far & currently offering an objective level to close the long & reverse back to short. Previous & updated 60-minute charts below.