While natural gas has been a short trade idea for the past month or so, /NG (or /QG, the MINY futures contract) offers an objective long enter here at support with potential divergences forming. Active traders short the /NG trade might opt to attempt to game a bounce trade or lower stops if holding out for more downside although, at this time, I will consider the recent nat gas short trade closed out as my preference is to book profits here (and reverse to long). The 120-minute chart below shows two potential bounce targets.

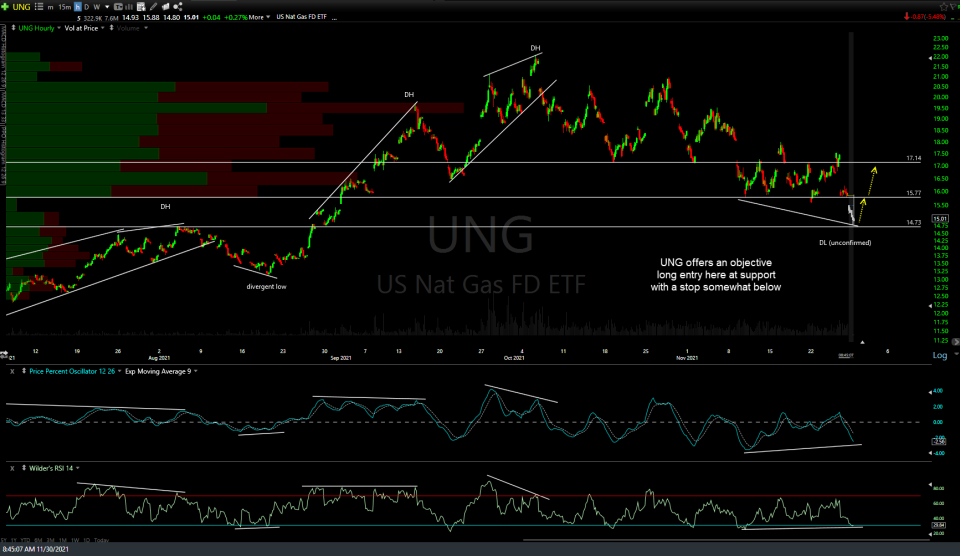

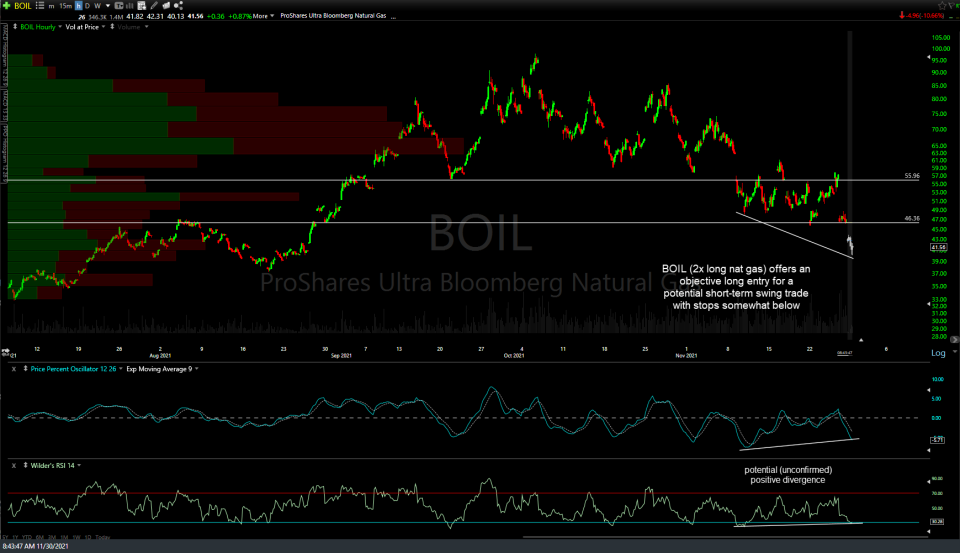

The 60-minute charts of UNG (1x long nat gas ETN) and BOIL (+2x) also list a couple of potential bounce targets, should the current divergences play out for a tradable bounce.

FYI- I have also reversed from short to long on /CL crude oil around 8:30 am EST today due to similar technicals (potential bullish divergences with /CL as support) although only for a relatively quick bounce trade as I still favor a substantial correction in crude in the coming weeks to months & may reverse back to short again, should crude fail to bounce. Charts to follow soon.