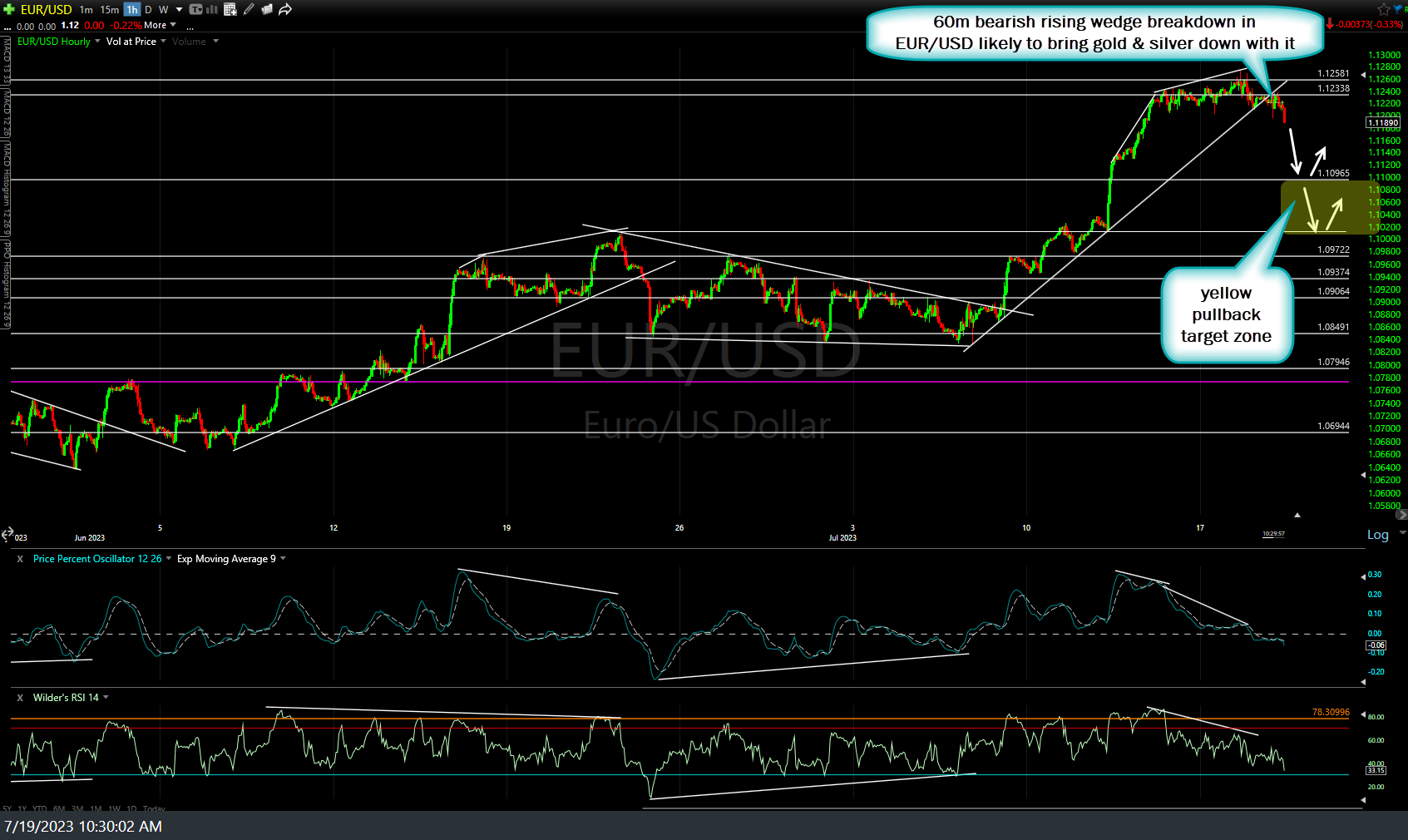

As the precious metals have a very high positive correlation to the Euro (inverse correlation to the US Dollar), this 60-minute bearish rising wedge breakdown in EUR/USD likely to bring gold & silver down with it.

Additionally, SLV (silver ETF) just hit my 23.07 price target today (it was a hair shy when the last update was posted yesterday) with a tradable pullback likely at this time. Yellow shaded area denotes my current preferred pullback target zone, currently favoring the bottom of the zone & reversing to a short position for a pullback trade at this time.

Likewise, GLD (gold ETF) is now rolling off the 183.77 price target/resistance level after hitting it & stalling out on it yesterday & today. Yellow preferred pullback zone for a counter-trend short trade or dip buyers marked on the 60-minute chart below.