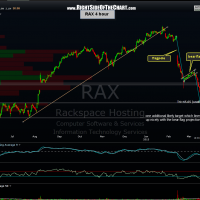

RAX was a short trade that recently hit it’s final target for a 30.2% in under 3 weeks from entry. At the time, I suggested booking full profits and considered the trade completed as a bounce was very likely but I also added an additional downside target for those wanting to let some of their position ride or for anyone wanting to short or re-short RAX on a bounce. The stock did make a healthy bounce from there and then set up in a beautiful bear flag continuation pattern (shown clearly below on the 4 hour chart), of which it broke down from recently and has fallen sharply since. What makes this such a nice example of a bear flag pattern, besides the well defined-flag, is the impulsive selling on both the “flagpole” leading up to the flag formation and the subsequent impulsive selling immediately following the price breakdown below the flag. The common measurement for a bear flag pattern is to take the distance of the flagpole and add it to the top of the flag, as shown on the 4 hour chart. I did add one more possible target which is slightly above that flag projection but lines up with some pretty solid support. However, I still prefer T4, the unofficial final target at 45.65.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}