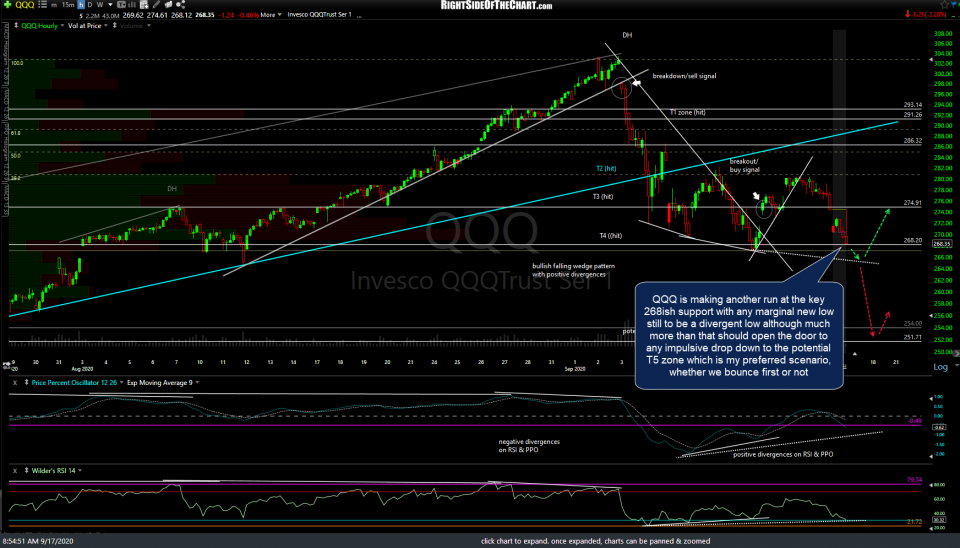

QQQ is making another run at the key 268ish support with any marginal new low still to be a divergent low although much more than that should open the door to any impulsive drop down to the potential T5 zone which is my preferred scenario, whether we bounce first or not. Sept 3rd & updated 60-minute chart below.

Likewise, /NQ (Nasdaq 100 futures) is coming up on the 3rd test of the 10920ish key support. Anything much more than a relatively minor & brief new low (which would be a divergent low) would be bearish & likely open the door to the next wave of selling. Yesterday’s 60-minute chart highlighting the objective short entry followed by today’s updated 60-minute chart below.

Keep in mind, shortly after this support level is clearly taken out (assuming that it is), the selling is likely to begin to accelerate once it starts to become clear to most that the counter-trend rally has ended & the next leg down within a larger correction off the Sept 2nd highs has begun.