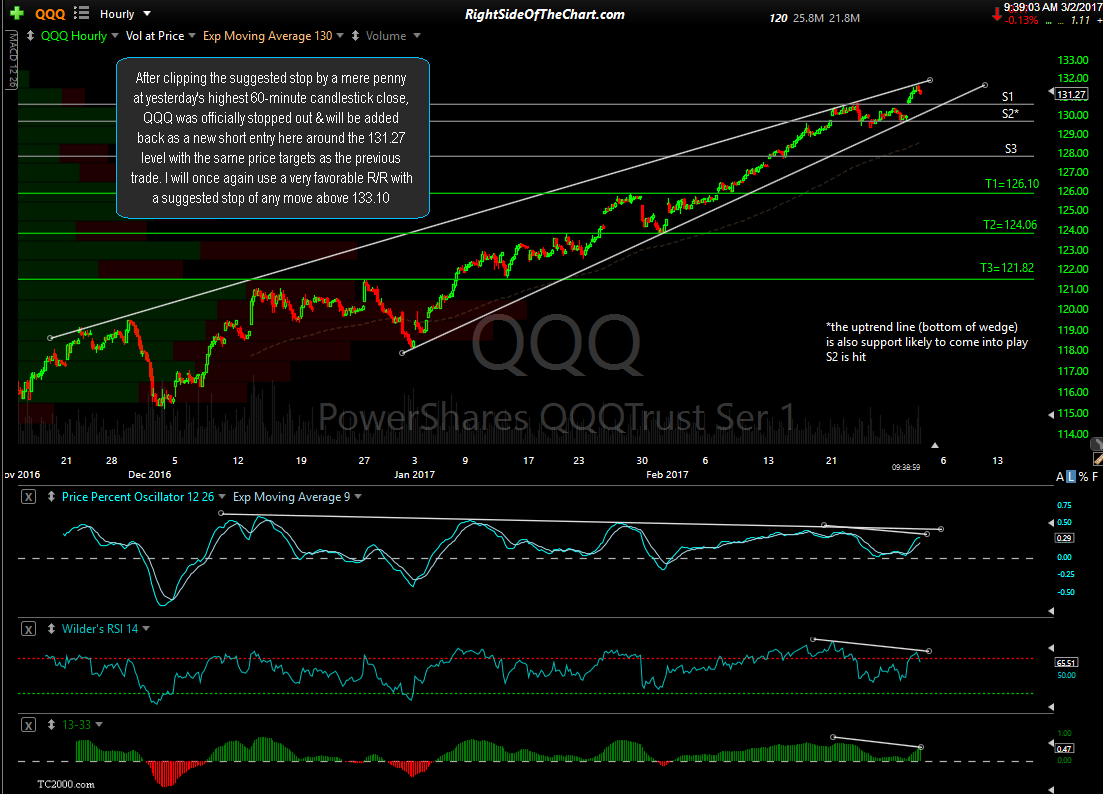

After clipping the suggested stop by a mere penny at yesterday’s highest 60-minute candlestick close, QQQ was officially stopped out & will be added back as a new short entry here around the 131.27 level with the same price targets as the previous trade. I will once again use a very favorable R/R of 5.2:1 with a suggested stop of any move above 133.10. The suggested beta-adjustment for this trade at this time is 1.0.

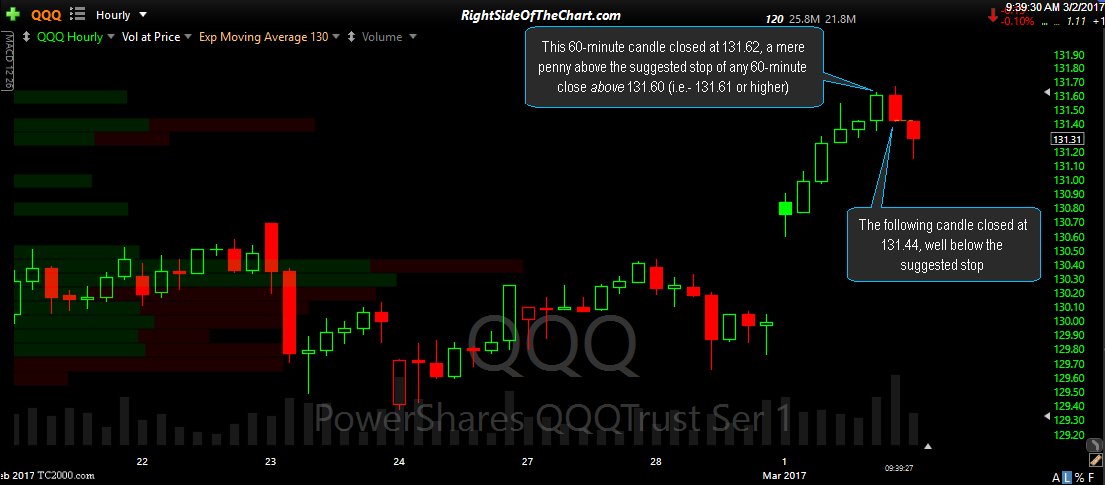

This 60-minute candle, the highest closing candlestick in yesterday’s rally short-squeeze highlighted on this zoomed in 60-minute chart of QQQ closed at 131.62, a mere penny above the suggested stop of any 60-minute close above 131.60 (i.e.- 131.61 or higher). I discussed this in last night’s market wrap video stating that since I did not catch that yesterday & modify or suspend the stops yesterday, that previous Active Short Trade on QQQ will now be moved to the Completed Trades category, stopped out for a negligible loss of 1.67%.

Also as mentioned in yesterday’s video, QQQ will be added as another new Active Short Trade with the same price targets although I’ve removed that larger, purple uptrend line/alternative target & cleaned this chart up a bit. For those that are either bullish on the market & looking to buy the dips or those only interested in shorting a quick & minor pullback, I have listed 3 minor support levels (S1 – S3), any or all of which could produce a reaction if/when hit.