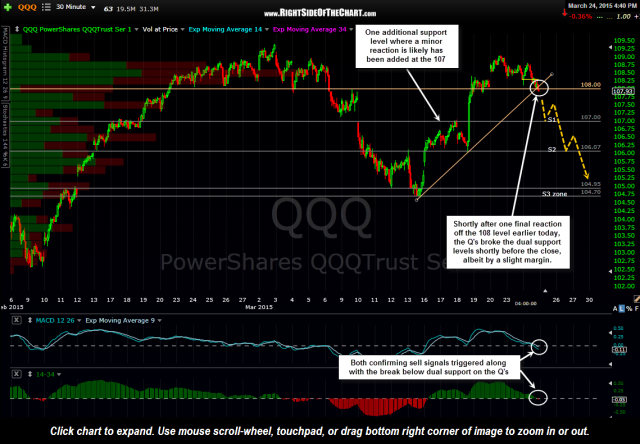

Shortly after one final reaction off the intersecting support levels around 108 earlier this afternoon, which helped to validate those levels as support, the QQQ went on to break below that dual support level shortly before the close, albeit by only a slight margin. We also received additional confirmation of a sell signal with both the MACD signal line crossing & closing below zero as well as a bearish crossover of the 14/34 ema pair on the 30 minute time frame.

As with the breakdown below price support, those confirming sell signals also only triggered by a very slight margin just below the close. With that being said, we need to see some follow-through to the downside tomorrow to further validate these sell signals & my best guess is that will happen at (via a gap down) or shortly after the open tomorrow morning.

Note that one additional minor support level, S1 at 107, has been added to this updated 30 minute chart. Although my preferred swing target remains the 100 area, these minor support levels might be useful for very active traders micro-managing a short position in the Q’s.

An example of micro-managing a short position would be to book profits and maybe even reverse the position (to a long) in an attempt to trade the initial reaction/bounce off each support level on the way down. These minor support levels can also be useful for typical swing traders in timing entries or add-ons to an existing short position. For example, it would not be prudent to short just before a support level but it would be objective to open/add-to a position once a support level has been taken out, particularly after an initial reaction off that level.