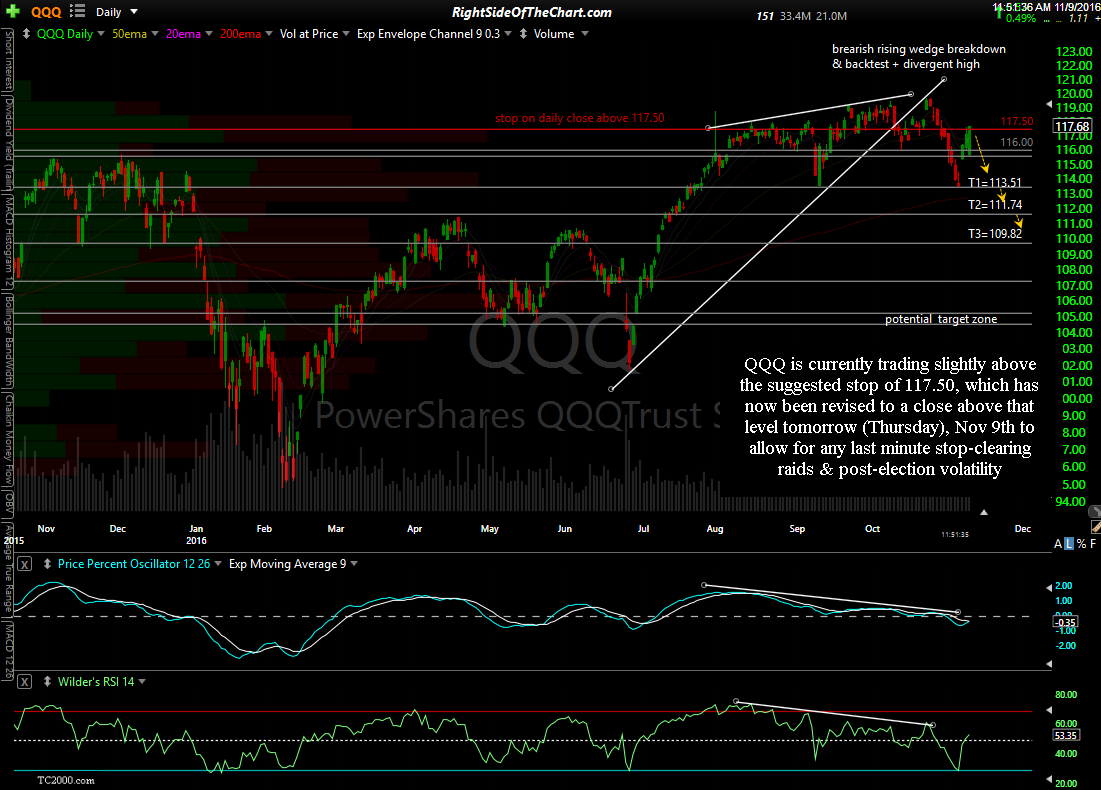

The official stops for the QQQ Active Short Trade will be reinstated to a daily close above 117.50, based on tomorrow’s (Thursday’s) close, not today’s. The stops were temporarily suspended yesterday in order to side-step the pre & post election “noise” or volatility & with today being the first trading day after the elections, the enhanced volatility continues with today’s post-election back & forth wide price swings in the market.

I realize that suspending stops until tomorrow’s close is quite unorthodox & allows for the potential of losses beyond those originally allotted for on this trade but I feel that is the best strategy at this time. I still have a very high degree of confidence that all of the bearish developments in the charts that have begun to manifest in the form of the broad markets moving lower in recent weeks will not only continue but is still in the early “controlled” selling stages of what is likely to prove to be a much deeper correction.

I’m often asked the specifics on how to use stops based on a daily close & there are a couple of options, especially when trading a very liquid security like QQQ. The first option would be to wait until shortly before the close (within the last minute of trading) & close the position out if it is currently poised to close comfortably above the suggested stop price. Another option if the stock or ETF is poised to print a close above the stop price shortly before the close of trading is to use a MOC (market-on-close) order, which will automatically close out the position at the close of trading. Finally, with an extremely liquid stock or ETF such as QQQ, there is usually plenty of liquidity in the after-hours trading session, which runs from 4-8pm ET, thereby allowing plenty to time to exit your position.

As always, suggested stops are only suggestions & may or may not be inline with your own risk tolerance, stop-allowances & trading rules. QQQ is currently trading slightly above the suggested stop of 117.50, which has now been revised to a close above that level tomorrow (Thursday), Nov 9th to allow for any last minute stop-clearing raids & post-election volatility. The Q’s also made an intraday pop above the 117.50 level briefly yesterday, only to see price drift back down below that level before the close & I would expect the same thing to happen today although I’d prefer to give it until tomorrow just to be safe.

In case anyone is wondering, I do still believe that this is an objective area to initiate or add short exposure on QQQ, ideally on or somewhat below the 117.50 but not above, using the same stop parameters as listed above.