The QQQ short trade closed at 196.48 yesterday, above the suggested stop of any close above 195.68 after hitting T2 for a 3.7% profit last Wednesday & reversing from there. This provides a 3.2% loss on the trade for those that did not book partial or full profits at T1 or T2. All previous posts associated with that trade will now be moved to the Completed Trades archives for future reference. Previous & updated charts below:

- QQQ 30m 4 March 27th

- QQQ 30m 6 March 27th

- QQQ 30m April 1st

- QQQ 30m April 6th close

This most recent QQQ official trade was stopped out after reversing off the 2nd price target, following the previous official short trade which was closed out on March 16th for a 16% gain just before the recent rally began with that trade following the previous long on QQQ which was hit the final target for a 5.4% gain on March 2nd, mere basis points from the top of the first counter-trend rally back in early March. More recently, QQQ was first posted as an unofficial long trade just off the lows back in mid-March, with an initial price target of T2 at 192.72 with an additional target of 192.72 (T3) added shortly afterward. QQQ went on to hit all three targets, with a near-perfect reversal off the final target (192.72) followed by a ~7% drop from there.

- QQQ 30m March 17th

- QQQ 30m March 24th

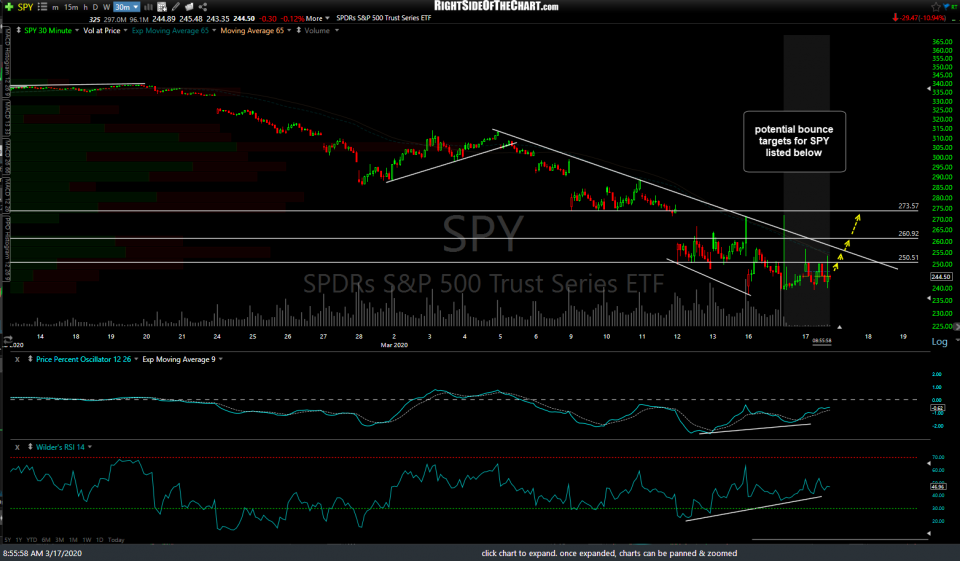

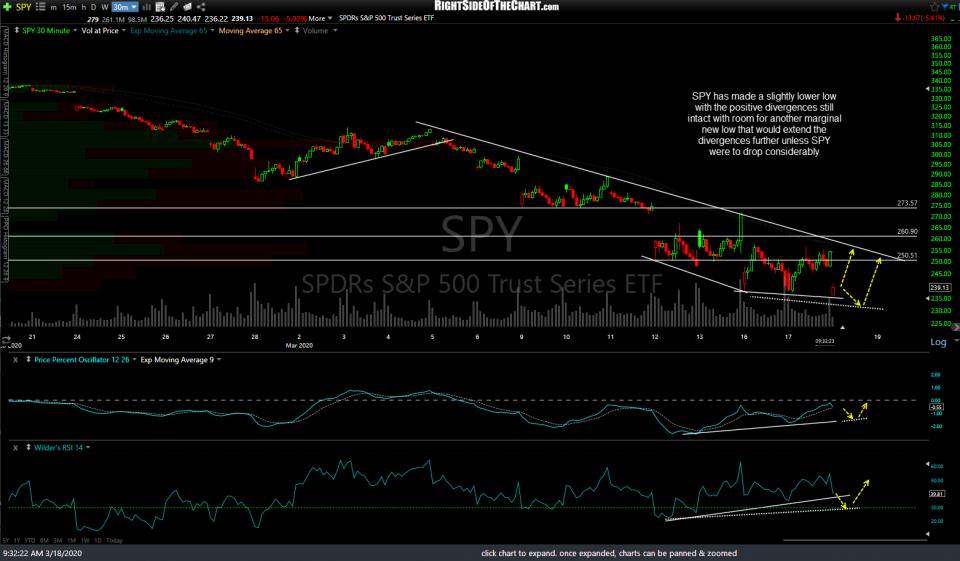

However, around the same time I laid out those bounce targets for QQQ when the market was bottoming, I had also listed my bounce targets for SPY, with a maximum/final bounce target of T3 at 273.57. When the market reversed off the QQQ final target, SPY had also made a near-perfect reversal off my 2nd price target, T2 at 260.90, also falling just over 7% from there. However, SPY later hit & reversed off the 244.93 support and has now (in the pre-market session) finally made a nearly perfect kiss of that final target first posted back on March 17th (last chart below).

- SPY 30m March 17th

- SPY 30m March 18th

- SPY 30m March 19th

- SPY 30m April 7th

All that brings us up to this point. As of now, SPY has just hit that final bounce target first laid out around 3-weeks ago along with a clearly bullish bias up until the 3rd target on QQQ was hit along with the 2nd target on SPY recently, at which point I flipped back to a bearish bias. However, I want to reiterate my near-term & intermediate-term bearish outlook for the market at this time, despite the relatively tight stop on the QQQ trade being hit at the close yesterday as well as the fact that the market is currently poised for a fairly large opening gap.

This bounce into that key resistance levels & max. bounce target on SPY, which also coincides with a rally into the 203.29 resistance as well as the key 50% Fibonacci retracement of the initial bear market leg down off the highs, provides a very objective short entry for a swing trade with one of the most favorable R/R‘s that I’ve seen on a short on the broad market in some time. I will wait to see how the market trades once all the players step onto the field at 9:30 today & may consider adding back another swing short trade on QQQ or SPY although I wanted to pass along these developments before then.