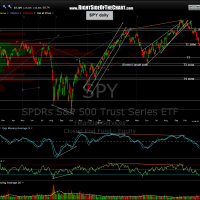

Both the QQQ & SPY (the two key indices that I have been tracking & listing targets on for months now) have now hit their next intermediate targets; T3 on the QQQ (4 hour & daily frames) and the bottom of T1 on the SPY. Throughout this downtrend, even as the markets overshot the top of the rising wedge patterns and made new highs, I was highly confident that any rallies or bounces back into resistance were good shorting opps, as the downside would resume shortly. However, although I have made a case that the markets might continue down to T4 (final intermediate downside target) before any substantial and lasting bounce, I could almost as easily see the market launching a decent bounce from at or near current levels.

Another way to phrase this would be to say that for the first time in months, I no longer believe that the risk/reward is clearly skewed to the short side. Any drop in the markets from current levels is likely to be limited in scope to about 4% while the potential to bounce that much or higher now that the lead dog (AAPL) has reached that uptrend line and the SPY & QQQ are at significant support levels negates any benefit of trying to milk those last few cents out of the downtrend. Yes, a market crash that takes us much lower is always possible but the odds are too small to warrant staying aggressively short and risk giving back profits on a bounce, which could be sharp. Here are the updated QQQ & SPY daily charts along with the 4 hour QQQ charts with the targets that have been in place for months now. I do favor the lower targets over time but would prefer to re-enter short once the R/R is more favorable.