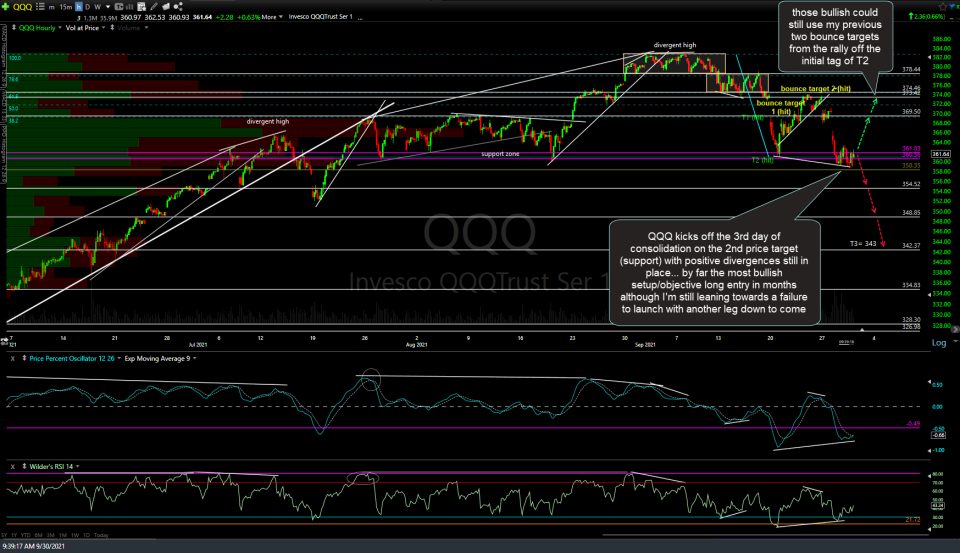

QQQ kicks off the 3rd day of consolidation on the 2nd price target (360ish support zone) with positive divergences still in place. As the 6%+ drop off the Sept 7th high was the biggest drop in many months, coupled with the fact that the market is at solid support, AND we have the first & largest positive divergence on the 60-minute charts in months within one of the most bullish uptrends in decades, this is by far the most bullish setup/objective long entry on QQQ in months & could still very well be the catalyst for the next leg to new highs & beyond.

With that being said, I’m still leaning towards a failure to launch (i.e.- nothing more than a relatively minor bounce) with another leg down soon to come. Of course, that is an extremely contrary call & those bullish could most certainly make a case to go long here, using my previous two bounce targets from the rally off the initial tag of T2, which were recently hit, or just let a long position on the Q’s ride with stops somewhat below the recent lows. Sitting tight on the index shorts for now with the next sell signal/objective add-on to come on a break below the recent lows on QQQ & SPY as well as AAPL (good support around 141.59), MSFT (good support around 283.70), & the other market-leading FAAMGs .

I will say that should my preferred scenario play out (another leg down to T3), it will likely come on very swift & impulsive drop once the recent lows are taken out as a failure of such a bullish setup, like the one in place on QQQ, to not play out would be quite bearish. With this being day three of consolidating on my 2nd price target/key support, the market is going to pick the next direction sooner or later.