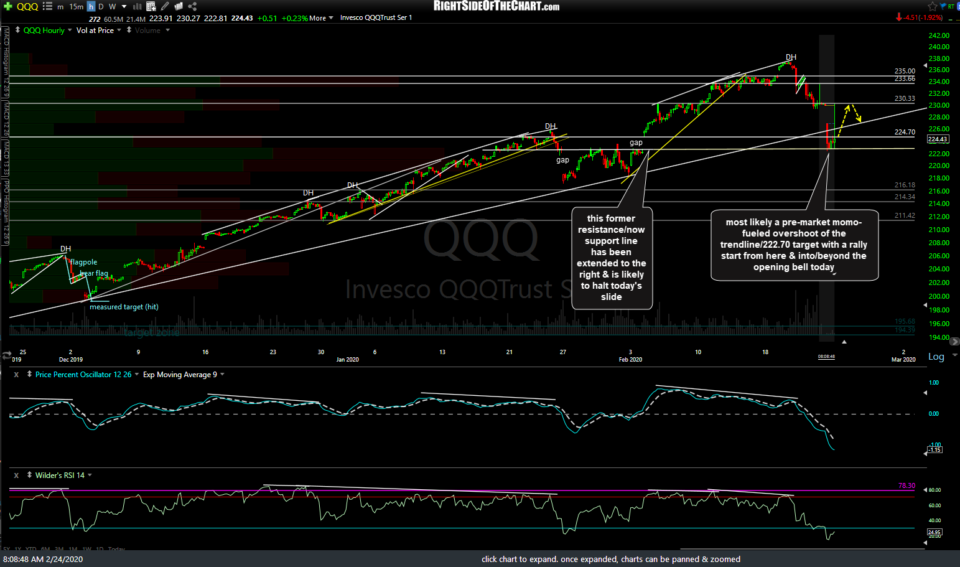

QQQ (Nasdaq 100 ETF) has now hit & slightly exceeded my final near-term swing target of the intersecting primary trendline off the Oct 3rd lows + 224.70 price support on what is most likely a momentum-fueled overshoot with a rally to start from here & carrying into/beyond the opening bell today. As such, it appears this is an objective level/time to reverse any index shorts to a long position for a bounce trade.

QQQ is also trading just above the 223ish support level which was one of the recent former resistance levels on my 60-minute chart & resistance, once broken, become support. As such, based on the current extreme near-term oversold conditions coupled with proximity to key support, it appears the odds for a tradable bounce from on or near current levels are favorable. Should the market start to rally today & clearly regain that Oct 3rd trendline, the 230.30ish level would be a likely bounce target. Likewise, /NQ (Nasdaq 100 futures) has overshot the trendline off the Dec 3rd low (not Oct 3rd, as on my QQQ 60m chart), falling to the 9160ish support where a bounce back to at least that TL & 9320ish S/R level is likely.