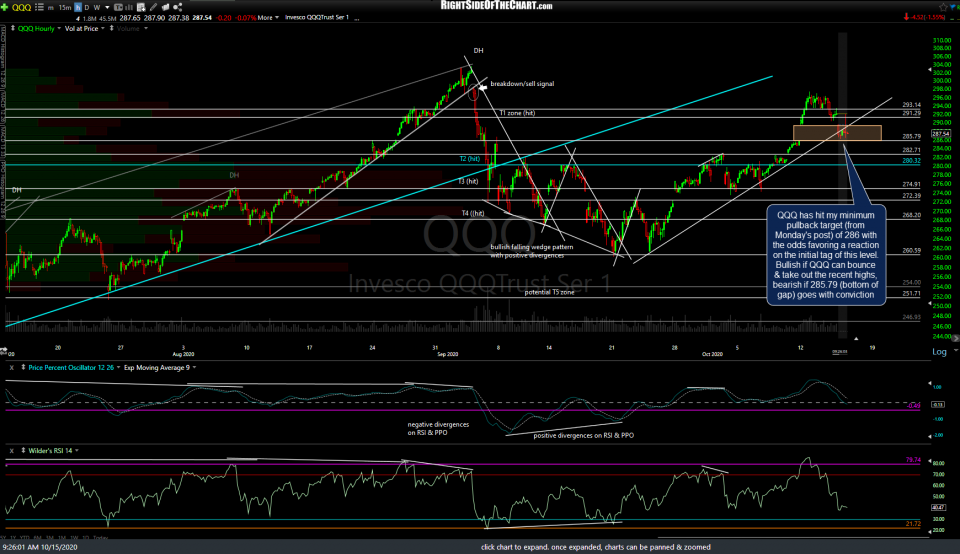

QQQ has hit my minimum pullback target of 286 with the odds favoring a reaction on the initial tag of this level. Bullish if QQQ can bounce & take out the recent highs, bearish if 285.79 (bottom of the gap) goes with conviction. 60-minute chart below.

The recent extreme overbought conditions & negative divergences have resulted in a 4.2% correction in /NQ so far with QQQ falling to support in the pre-market session.

The uptrend line + 159ish minimum target zone on IWM has also just been hit. Bullish if IWM can rally off this support & take out the previous highs, bearish if 158.90 goes with conviction.

/RTY (Russell 2000 futures) is coming up on the 1592 support/former breakout level with the negative divergences & overbought conditions playing out for a 3.4% pullback so far.