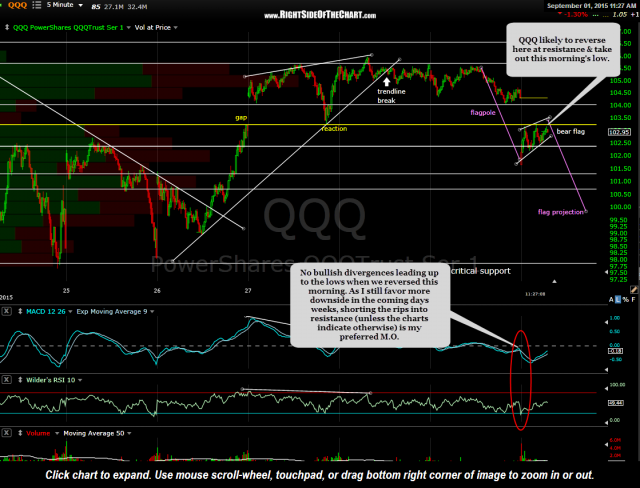

I just returned to my desk & in reviewing the charts, factoring in my bearish bias discussed in the recent market videos, it would appear that the QQQ (and other US stock indices) are likely to reverse here at this resistance level highlighted on the recent 5 minute charts. Without any positive divergences in place on any timeframes, including all intraday periods, the odds favor a reversal here with a move down beyond where the markets reversed immediately following the open today, to at least my next downside target/support level around 101.30 and quite possibly a continued move down towards the 97.80ish critical support level.

As I still favor more downside in the coming days & possibly weeks+, shorting the rips into resistance (unless the charts indicate otherwise) is my preferred M.O. for the time being. Just to clarify, lest some of my market analysis and trades in recent days sound confusing, I am current wearing two hats; Swing Trader & Day Trader.

As a swing trader, I posted adding back most of my short positions that were close out on the big drop Monday before last. As a day trader, this market has been very lucrative and somewhat easy to trade by going long on the dips to support & short on the rips to resistance (again, assuming the intraday charts confirm the entry).

To expand, here is my reply to an email this morning:

Congrats on your ACI trade. I also shorted USO yesterday at a key fib retracement level, expecting both a pullback in crude as well as those 3 recent run-away coal stocks (but of the three, I only shorted ACI).

AMGN, yes, still favor at least T1 and personally, I’m not concerned with any counter-trend pops or rallies until we get there, unless something changes in the charts that convinces me otherwise. IF I’m right and a new bear market is underway, or at the very least, last Monday’s lows are going to be taken out, then you just have to take the plunge & hold your breath by shorting the rips back to resistance (like we had numerous opps last week to do), setting the appropriate stops somewhat above, and then be patient while the market grinds lower, even though there will be very impressive rallies as the lemmings continue to buy the dips for a while. It’s not always easy to watch nice paper gains quickly evaporate on those rips and of course, I’m referring to swing trading this market short, not the day trades that I’ve also been posting lately.

Best of luck & FWIW, I think once/if AMGN takes out the 144.50 level, that should open the door to a quick run down to the 132 (T1) area. The only concern with that, as well as the broad markets taking out the critical support levels that I posted earlier today, is that I can see the possibility of one more thrust lower that slightly undercuts (or maybe even reverses just above) last Monday’s lows, before a sustained rally that lasts weeks or possibly months. Most importantly, where & when to cover all the individual stock shorts trade ideas that I discussed recently will depend on where & when to cover the index shorts as nearly all those stocks will follow/trade in line with the broad market. Pls pardon any typos. Just returned to my desk & trying to catch up on the charts & manage my trades. (end reply)

Bottom line is to define one’s trading style (swing trader, day trader, trend trader, investor, etc…), then formulate a trading plan and stick with it until/unless the charts convince you otherwise. One of the recent market videos discussed in detail the fact that by nearly every metric that I follow, both the short-term and intermediate-term trend have been bearish for weeks now, before the big drop on Monday the 24th and even the short-term indicators remained bearish into the end of last week, despite what appeared to be very impressive and likely quite bullish to many. Also covered in detail were some extremely reliable long-term indicators that, although very close, have yet to confirm that the primary trend is bearish. As such, long-term traders & investors should use caution/stops if buying the dips.

Regarding my trading plan for my short positions, other than covering when the odds of a meaningful bounce are highly likely (e.g.- as in pre-market & immediately following the open on Monday the 24th), the follow quote & video summarize my current thoughts:

-Jesse Livermore

Click here for an analogy on taking the quick buck when trading vs. capturing the big move (warning, offensive language!), Robert Duvall’s advice to hot-shot rookie cop Sean Penn in the 1998 film Colors.