There is an old saying that the market abhors a vacuum and all gaps will be filled.

-StockCharts.com, Chart School

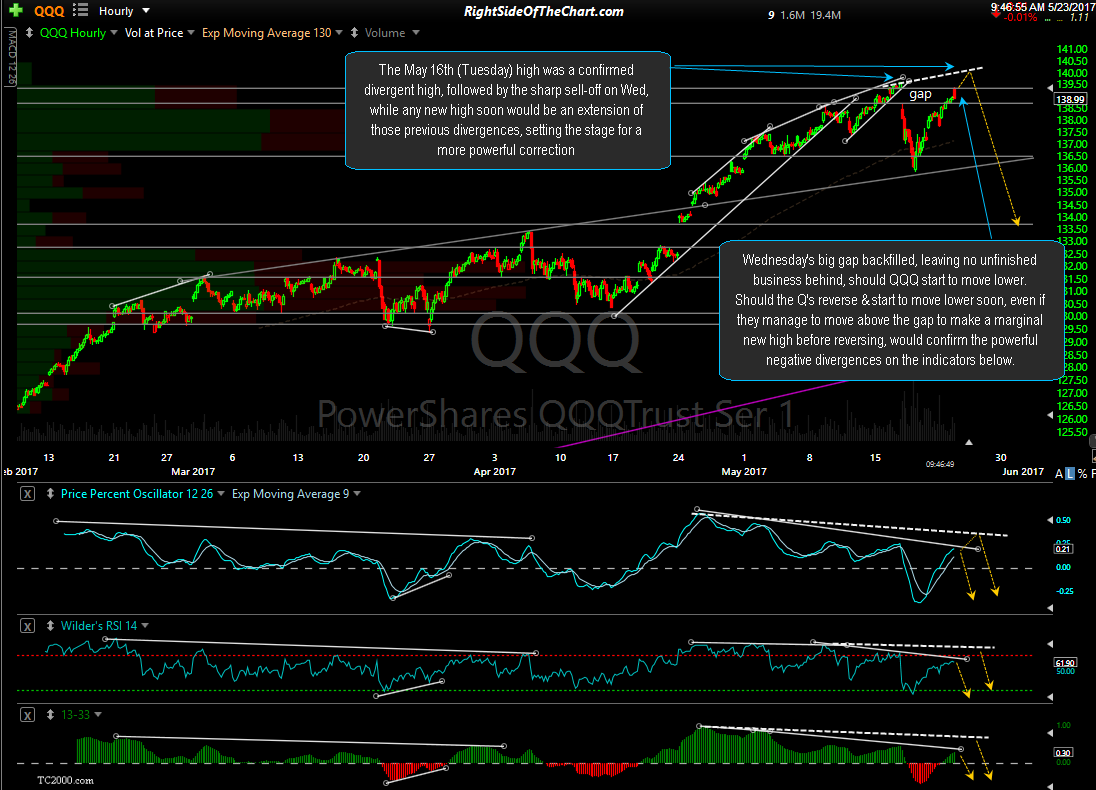

Wednesday’s big gap on QQQ has been backfilled, leaving no unfinished business behind, should the market start to move lower. If the Q’s were to reverse & start to move lower soon, even if they manage to move above the gap to make a marginal new high before reversing, would confirm the powerful negative divergences on the indicators below. As the 60-minute chart below shows, the May 16th (Tuesday) high was a confirmed divergent high, followed by the sharp sell-off on Wednesday, while any new high soon would be an extension of those previous divergences, setting the stage for an even more powerful correction as typically, the more powerful the divergences, the more powerful the ensuing trend reversal. I’d put about nearly equal odds with a slight advantage to QQQ making a marginal new high (above last Tuesday’s high) before reversing with a very low chance of the market moving much beyond (3%+) that previous reaction high before reversing.