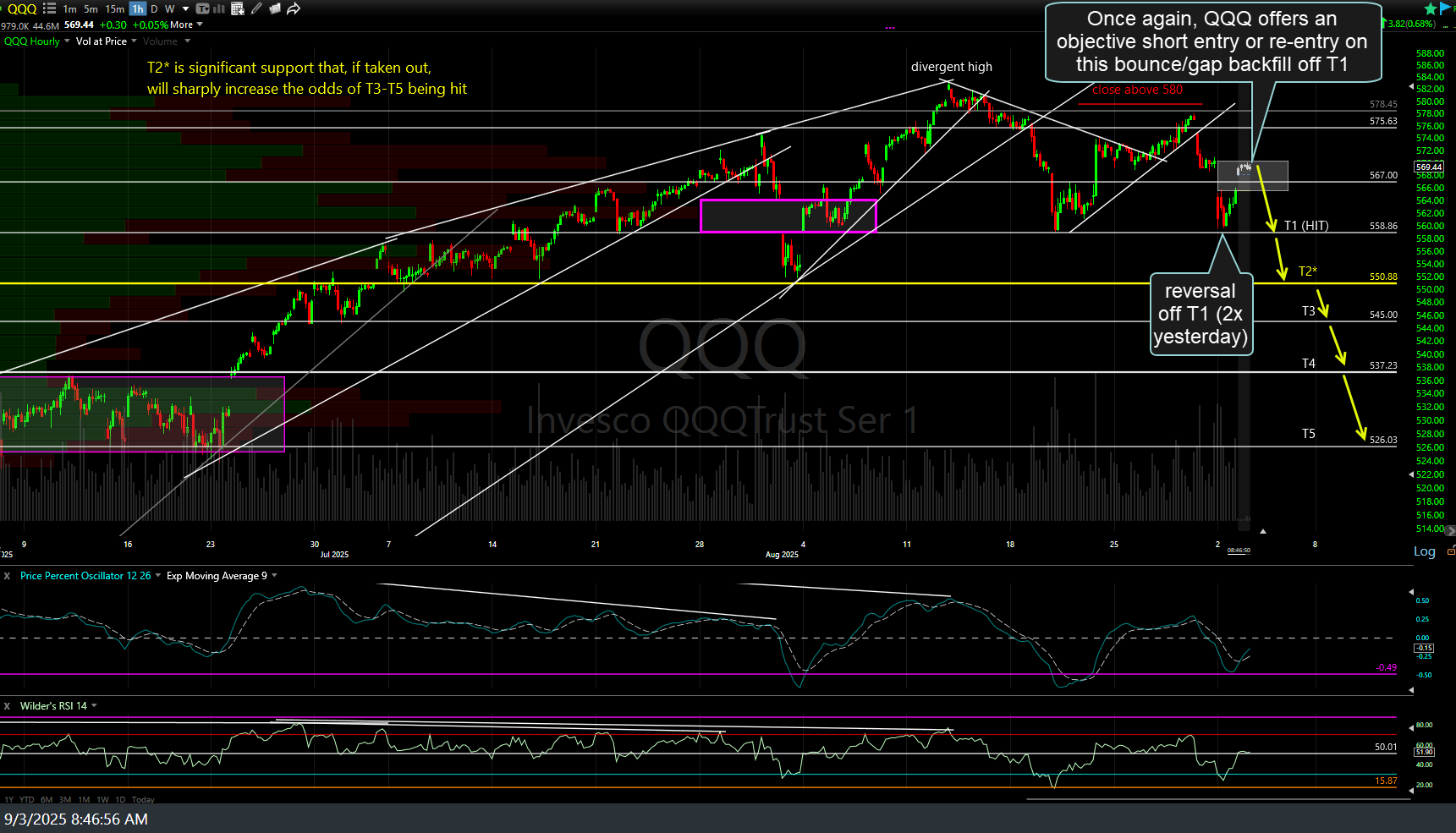

Once again, QQQ (Nasdaq 100 ETF) offers an objective short entry or re-entry on this bounce back of T1 into my re-shorting zone, which is also a backfill of the gap that defined the top of the re-shorting zone I posted yesterday. Updated 60-minute chart with the white candles showing the pre-market trades. Suggested stop remains on a close above 580, for now.

This 23000ish support on /NQ (Nasdaq 100 futures) aligns with T1 on QQQ & will trigger the next sell signal when taken out. 60-minute chart below.

I’ll be away from my desk for a few hours this morning & will reply to any chart requests or questions around lunch time. Natural gas (UNG or /NG, /QG, etc.. still one of the better-looking commodities on the long side right now, with the charts of the grains (wheat, corn, & soybeans) still constructive. /GF (feeder cattle) & /LE (live cattle) futures still setting up a nice potential swing/trend shorts. More updates to follow.