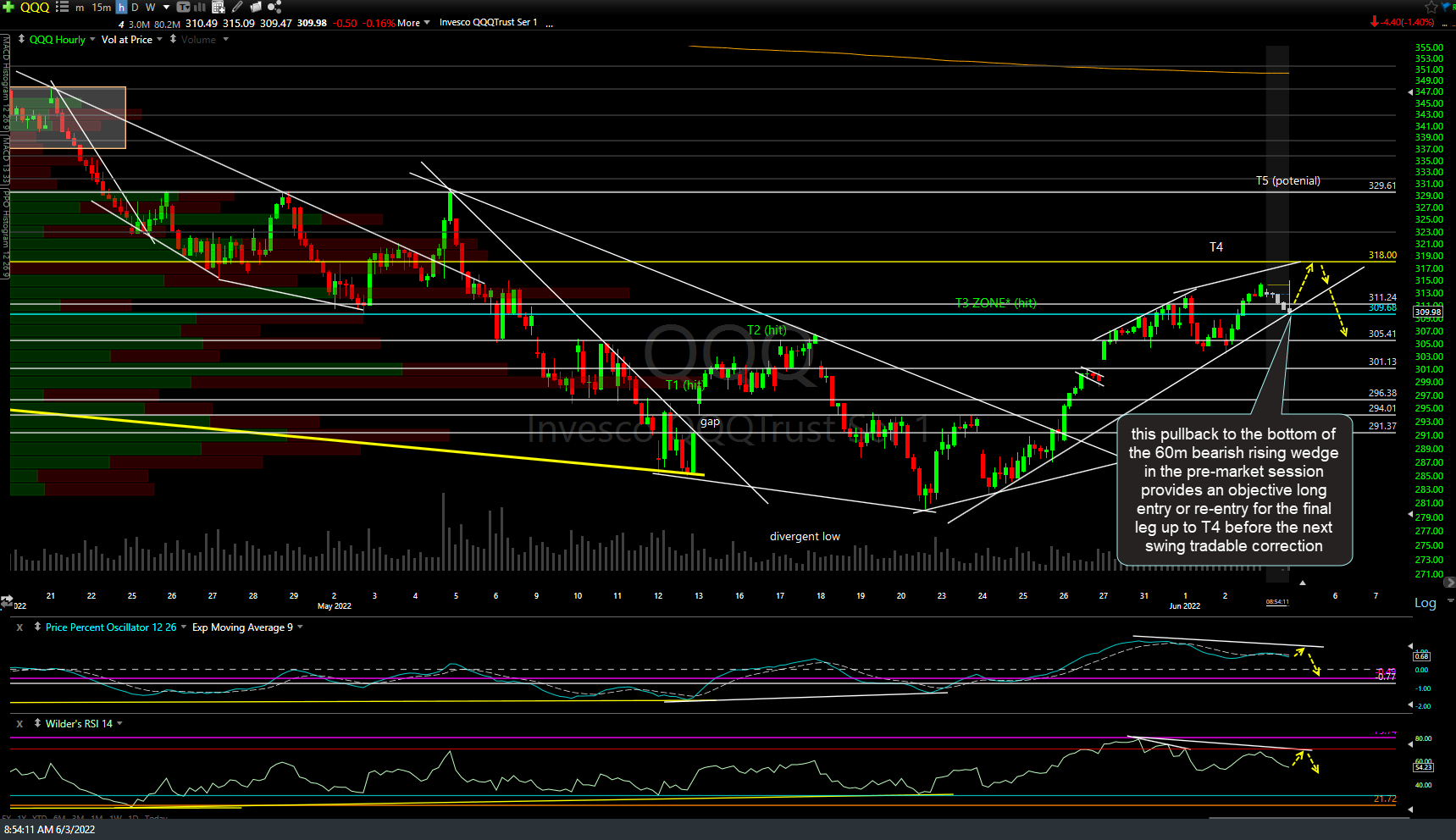

This pullback to the bottom of the 60-minute bearish rising wedge in the pre-market session provides an objective long entry or re-entry for the final leg up to T4 before the next swing tradable correction. QQQ is currently trading at 309.98 which is also price support in addition to uptrend line support.

White candlesticks are the pre-market session trades with the yellow arrows my preferred scenario. As per this reply in the comments shortly after the regular session closed yesterday, I had closed out all my /NQ longs shortly before the close yesterday & then booked full profits on all shares of AMZN as well as some of my additional swing longs on QLD & TQQQ across multiple accounts in the AH session & I am re-entering the /NQ longs for what I suspect will be one more thrust higher up towards T4 on the 60-minute chart of QQQ followed by a reversal & breakdown below the 60-minute rising wedge pattern.

While the current negative divergences on both the QQQ & /NQ 60-minute charts may certainly play out for a deeper correction from here (hence, stops somewhat below current levels), it appears to me that one more thrust up in QQQ as well as SPY & IWM before a more meaningful pullback is the most likely scenario.