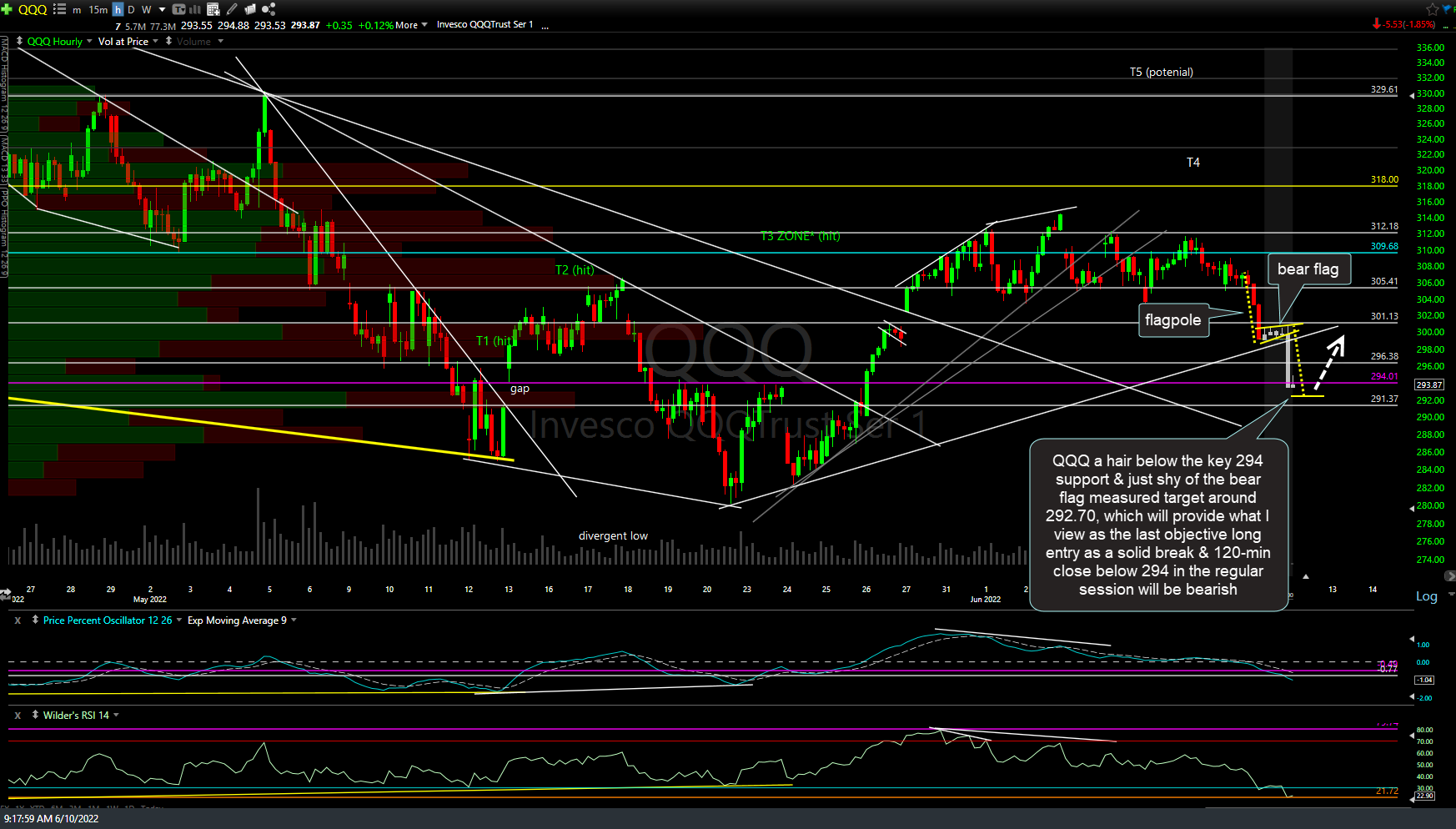

QQQ formed a bear flag continuation pattern in the after-hours & pre-market session with a textbook impulsive breakdown below that continuation pattern following the release of the hot CPI numbers at 8:30 am today. When I took this screenshot, QQQ was a hair below the key 294 support & just shy of the bear flag measured target around 292.70ish & the full measured target was since hit, providing what I view as the last objective long entry as a solid break & 120-min close below 294 in the regular session will be bearish.

My preference to use at least a 120-minute solid close below 294 has to do with the fact QQQ just opened below that level with a large amount of order imbalanced to be cleared out at the open. I also believe a long entry around 293-294 with relatively tight stops offers the best R/R on indexes long since the markets & many key stocks hit some of my long-term swing/trend targets & key support levels a few weeks ago.

I’m not pushing the longs as hard as I was back then since we’ve now already had the initial reaction/tradable bounce off those levels. That bounce may or may not have run its full course & while I still suspect the latter, I most certainly wouldn’t rule out the former. I also still favor the $NDX over the $SPX at this time.