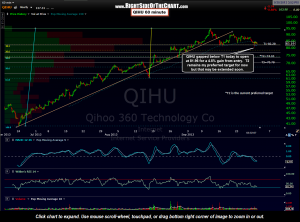

The QIHU Active Short Trade gapped below the first target (60 minute chart) today to open at 81.96 for a quick 4.5% gain. Standing buy-to-cover limit orders are filled at the better of the limit price that was set (in this case, 82.28 for those targeting T1) or lower, in the case of a gap below that price, as QIHU experienced today. The same thing works in reverse when long as a standing sell limit order at your profit target can only be filled at your limit price or better, should the stock gap above it. For now my preferred target remains T2 on the 60 minute chart (74.10) but that may very well be extended if the uptrend lines on the 4-hour QQQ & SPY charts are taken out this week. Updated QIHU 60 minute chart:

The QIHU Active Short Trade gapped below the first target (60 minute chart) today to open at 81.96 for a quick 4.5% gain. Standing buy-to-cover limit orders are filled at the better of the limit price that was set (in this case, 82.28 for those targeting T1) or lower, in the case of a gap below that price, as QIHU experienced today. The same thing works in reverse when long as a standing sell limit order at your profit target can only be filled at your limit price or better, should the stock gap above it. For now my preferred target remains T2 on the 60 minute chart (74.10) but that may very well be extended if the uptrend lines on the 4-hour QQQ & SPY charts are taken out this week. Updated QIHU 60 minute chart: