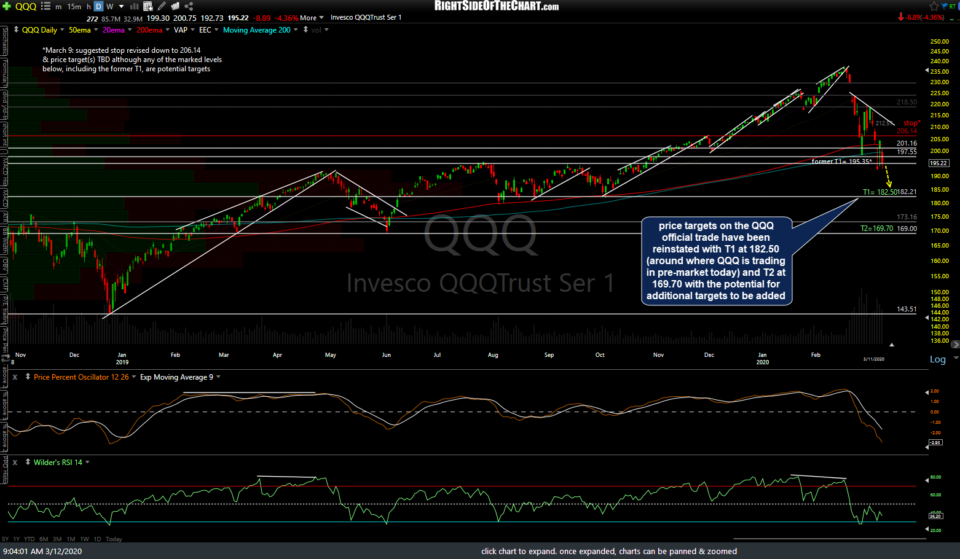

The initial sole price target for the QQQ Active Short Swing Trade of T1 at 195.35 was pulled in order to allow for that trade to morph into a ‘runner’ short trade with the potential to capture a much larger drop than I was initially targeting. After extensive review of the charts, I have decided to add back a couple of new price targets; T1 at 182.50 and T2 at 169.70.

As expected in my final post for the day last night, the stock futures did go on to hit the 5% lock-limit down values and have been pinned on those levels, /ES 2601 and /NQ 7601.50, for most of the morning session so far today. As ETFs are not subject to the same 5% down limit as the stock futures are in Globex trading (the non-regular trading session or everything outside 9:30-4 pm EST), QQQ is currently trading down 6½% around 182.60 as I type after trading as low as 182.00 so far in today’s pre-market session.

Each price target for the official trades on rsotc.com are levels where I believe the odds for a reaction on the initial tag of that level are decent. As such, one could use this first target of 182.50 to book partial or full profits or continue to hold a QQQ short trade for the potential for additional gains, which is still likely in the coming days, weeks or possibly months although the odds for a sharp counter-trend rally start to increase substantially with every tick lower at this time due to the extreme oversold conditions, the $VIX trading at or above the extreme high-end of its range (indication massive amounts of put buying vs. call buying), and the increased likelihood of some type of extreme & drastic interventions by the government, particularly a president obsessed with the stock market so I wouldn’t be surprised to see something along the lines at the talks of banning short-selling (which would be a colossal mistake but could provide a short-term boost to stock prices, ultimately to be followed by nothing short of an outright crash, if a ban on short-selling was to be implemented).