There really aren’t many compelling trading opportunities that stand out today, especially considering the markets are closed for the Thanksgiving holiday tomorrow followed by an early 1 pm close on Friday with many traders & market participants cutting out earlier today. As such, trading volumes will likely be unusually low for the remainder of the week which typically leads to an increase in whipsaw signals (i.e.- false breakouts).

The initial reaction to the trio of big economic reports (GDP, Durable Goods & Jobless Claims) at 8:30 am today was essentially a non-event, with an initial minor pop in the stock futures followed by a 100%+ fade of that initial rally so far to bring the stock index futures to essential flat, with /ES (S&P 500 futures) trading at 0.06% as I type with just over 15-minutes before the opening bell.

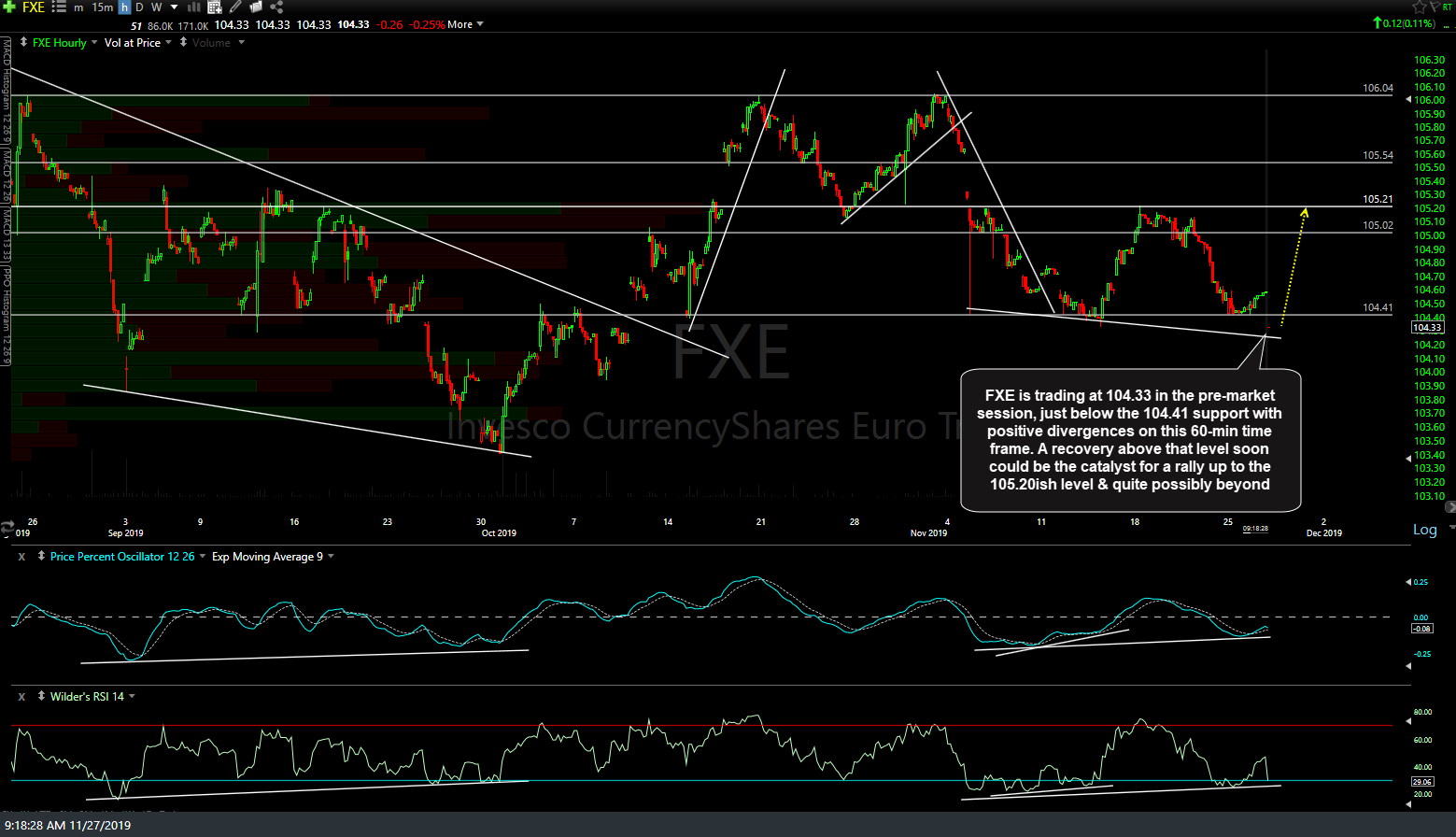

While my preference remains to wait until next week before resuming trading, for those looking for trade ideas, /E7 (Euro futures) and FXE (Euro ETF) is trading at the 1.1010 support level with positive divergences that increase the odds for a reversal & rally off this level, even if the Euro makes a slight undercut below that support first, as long as the divergences remain intact.

FXE (Euro ETN) is trading at 104.33 in the pre-market session, just below the 104.41 support with positive divergences on this 60-min time frame. A recovery above that level soon could be the catalyst for a rally up to the 105.20ish level & quite possibly beyond.

I plan to spend some time today replying to any questions & chart requests within the trading room as well as updating the existing trade ideas. I will be leaving town for Thanksgiving, returning to my desk over the weekend so unless something big were to happen in the market on Friday (doubtful), there won’t be any updates or analysis posted this Friday.

Happy Thanksgiving,

-RP