As the long trade ideas continue to be unusually light, I wanted to pass along this swing trade idea on platinum that I posted in the trading room early today & on the site as unofficial short trade idea just a couple months ago. (my trading room comments & charts cut & pasted below). I’m passing this one along as an unofficial trade idea for now but might add it as an official trade idea as soon, depending on how it acts from here.

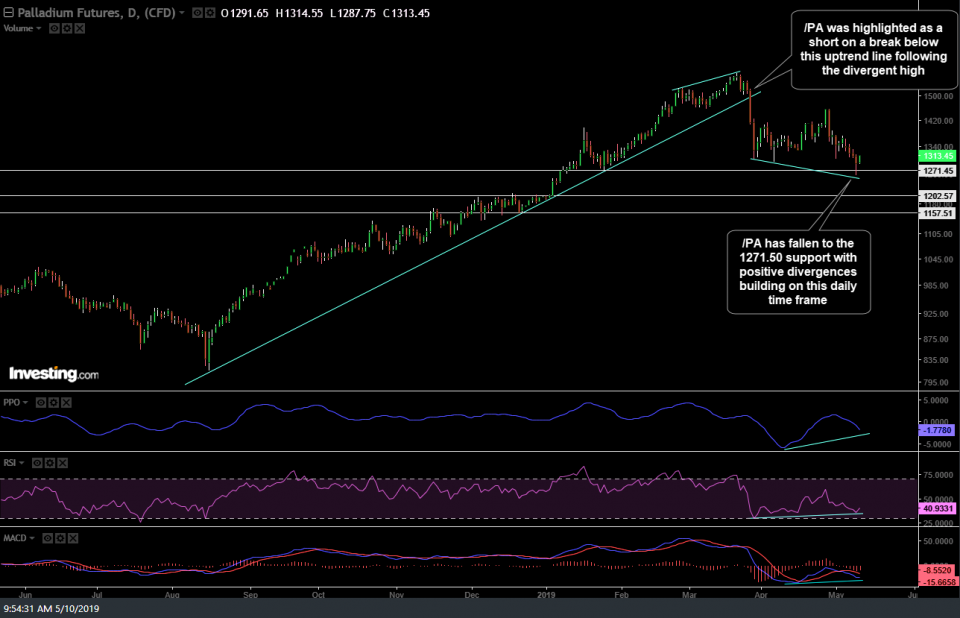

/PA palladium futures (or the ETF, PALL) starting to look interesting for a swing long after recently being posted as a swing short a couple of months back. I\’ll post some charts when I get a minute but bullish divergences building on the 60-min chart as /PA falls to support on the daily. There’s a minor downtrend line on the /PA 60-min it needs to take out so basically, a pop over the previous reaction high of 1315 should do the trick.

Here’s are the charts of the /PA long setup mentioned below. Might make this an official trade but wanted to get it out here asap for those interested in some non-stock market-related trade ideas. PALL is the palladium ETF for those without a futures account or the capital to trade /PA, which accounts for about $132K of palladium per contract.

- PA daily May 10th

- PA 60-min May 10th

As with any ETF or ETN that tracks a commodity or precious metal by via the futures contracts, PALL does a decent but not perfect job of tracking palladium prices. As such, I will need to study the charts a bit future to hone done some potential price targets on both but for now, I favor a rally up to at least the 127.60ish area on PALL & quite likely the 135-137ish resistance zone.

/PA & PALL were also highlighted as a short setup with a sell signal to come on a break below that 7-month steep uptrend line following the divergent high back in March with palladium falling over 20% since that previous divergent high.

- PA daily Feb 22nd

- PALL daily chart March 27th

- PA 60-min chart March 27th