This “Powell-Pop” has brought /NQ (Nasdaq 100 futures) up toward the downtrend line (60-minute chart) and offers an objective level to start scaling in or add to a starter swing/trend short position on /NQ or QQQ.

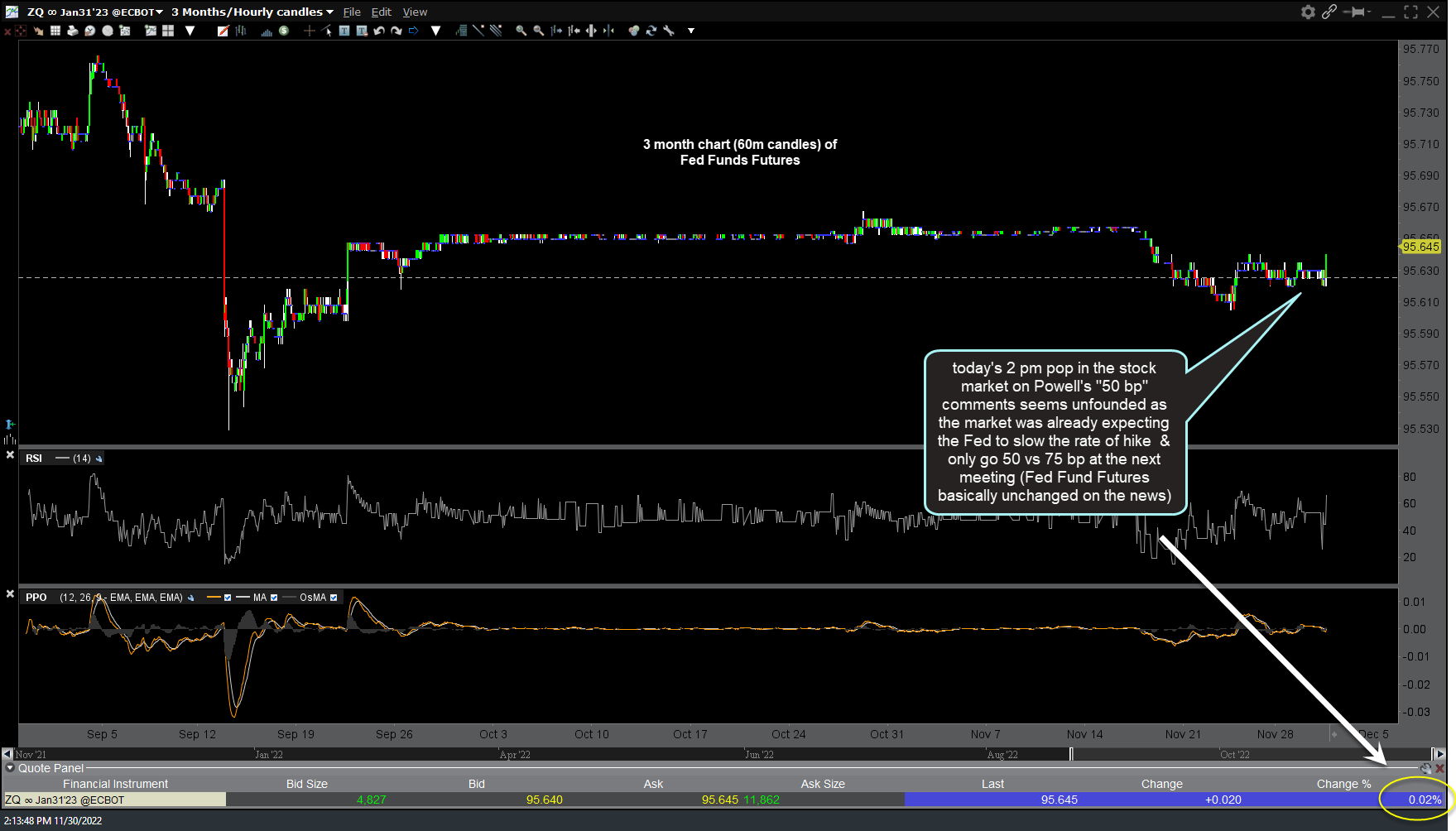

Fed Chair Jerome Powell indicated that the central bank is on track to raise interest rates by 50 bp (½%) at the next meeting in two weeks vs. another 75 bp hike as per the previous 4 increases. His comments caused an immediate rally in the major indexes only the stock market seems to have missed the memo that only 50 bp at the next meeting was pretty much already what Wall Street was expecting as per the Fed Funds Futures, which essentially haven’t budged on the news.

As per today’s video & previous trade idea on /NQ, the ideal stop for active traders would have been just above the 11596 level (previous reaction high), and triggered right after the headlines hit whereas it was also mentioned as an objective time to begin scaling into a swing or trend short position on any of the indexes (/NQ, QQQ, SPY, IWM, etc..) & as such, this algo-fueled short-covering & over-reaction (based on the aforementioned “rate of Fed Funds increases already expected to begin slowing at the next meeting”), this appears to be a very objective level to either initial or add-to a swing/trend short position as well as an objective short entry for active traders to short this spike into downtrend line resistance for a pullback/fade-the-rally trade.

…and yes, a headline about the House imposing a railroad labor deal hit around the same time but that is another “baked in the cake” headling IMO, as this isn’t the first rail strike & this one, as every other one in history, will, of course, be settled (via gov’t decree or not) as they have been in the past.